Stripe is amazing at payment processing—no one’s debating that.

But when it’s time to dig deeper, to actually understand who is buying from you, why they’re buying, or how you could sell more? – That’s where Stripe payment analytics can leave you hanging.

If you’re running an e-commerce business, you’re likely craving insights that go beyond basic transactions, like tracking customer behavior, lifetime value, and growth metrics.

Unfortunately, Stripe’s reporting doesn’t quite deliver on these fronts. So, what crucial insights are you missing, and how does it affect your growth?

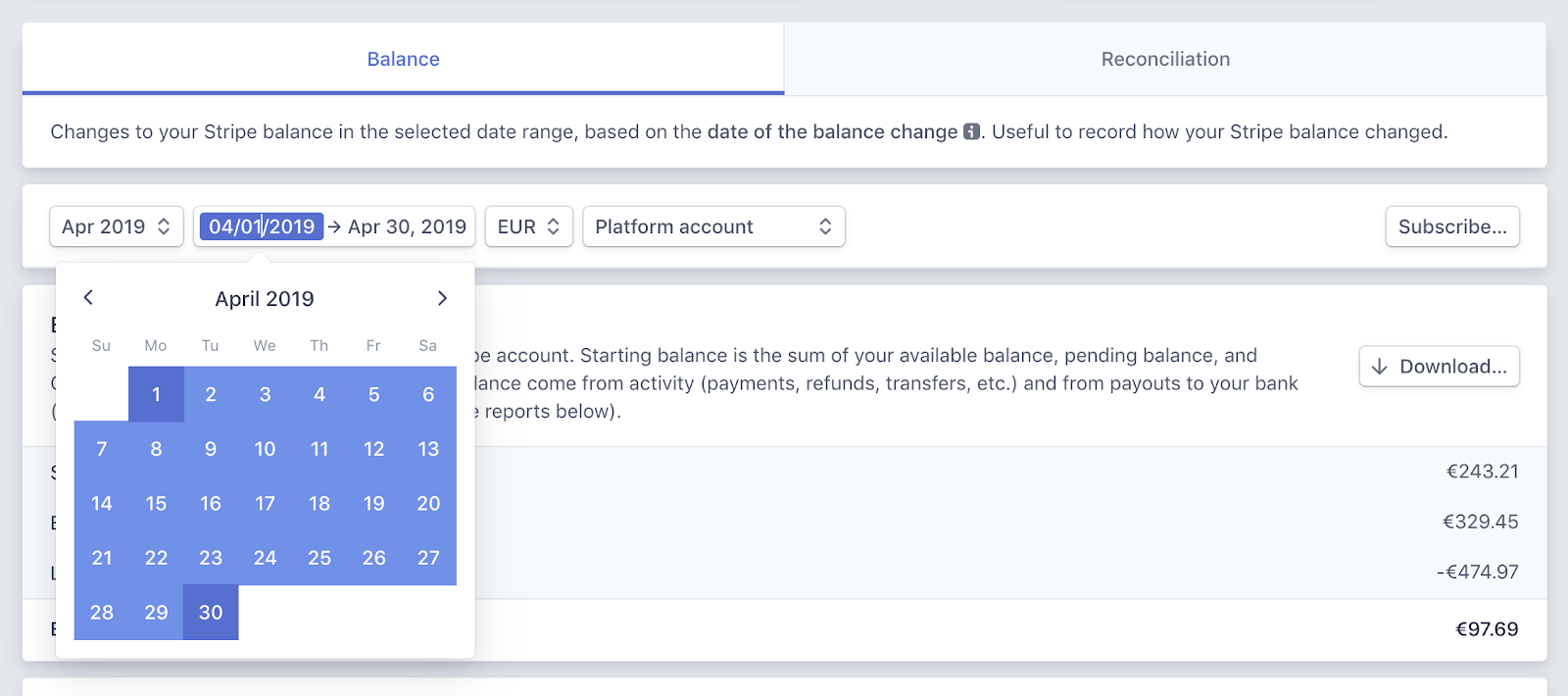

Here’s where Stripe payment analytics face limitations:

- Revenue forecasting: stripe analytics displays Monthly Recurring Revenue (MRR) but lacks tools to forecast future revenue.

- Detailed subscription insights: It’s challenging to differentiate between upgrades, downgrades, and refunds—insights crucial for managing subscription-based revenue.

- Cancellation insights: While Stripe indicates when customers leave, it doesn’t explain why they churn.

- Trial user tracking: There’s no easy way to separate trial users from paying customers.

- Customer profiling: Limited data makes it hard to get a comprehensive view of your customers.

- Customer segmentation: Granular segmentation is unavailable, which makes it difficult to cross-reference plans with churned customers.

- Customer lifetime value: With no LTV data, Stripe users miss insights on long-term customer value.

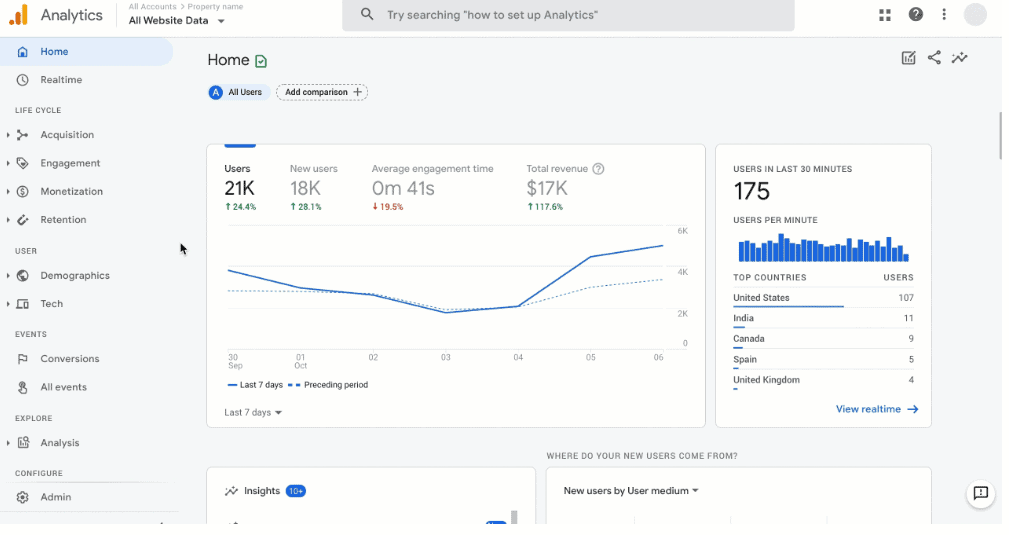

Google Analytics integration: A complex alternative

To overcome these gaps, some businesses turn to Google Analytics. However, integrating Google Analytics with Stripe is far from simple:

- You’ll need custom events for each purchase and webhooks to capture transaction data.

- Challenges like timezone mismatches and tracking discrepancies are common, especially with subscriptions and refunds.

In short, Google Analytics integration with Stripe is doable but tedious, particularly for those seeking comprehensive insights.

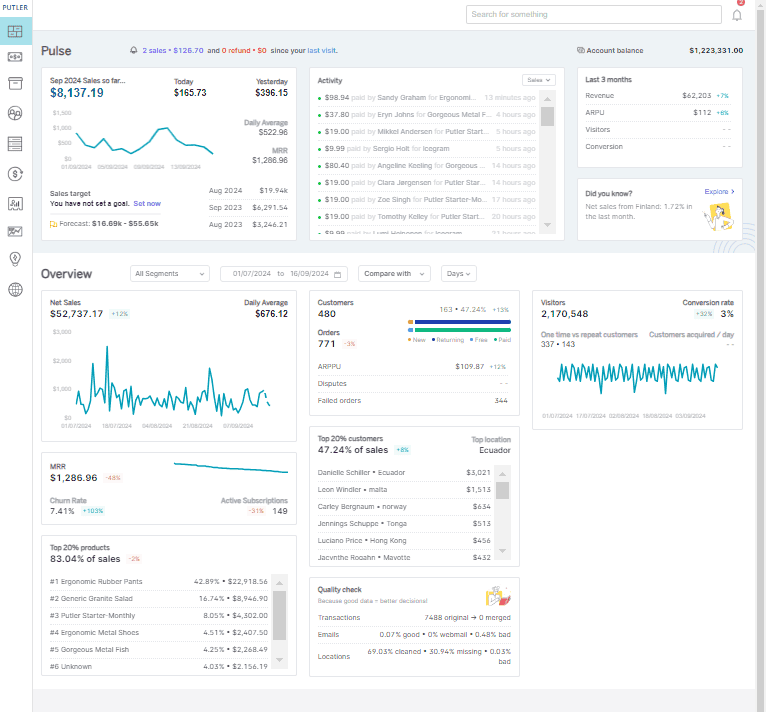

Complete analytics solution for Stripe

Putler offers a smart solution for businesses looking for advanced analytics to complement their Stripe payment analytics. Here’s how it stands out:

- Effortless integration: Connect Putler to Stripe with a few clicks, and it integrates seamlessly with other e-commerce platforms and payment gateways.

- Revenue forecasting: Putler analyzes historical sales to forecast future revenue, supporting proactive planning.

- RFM segmentation: Putler’s RFM segmentation categorizes customers into high-value, loyal, and at-risk groups, providing a clear view of customer behavior patterns.

- Enhanced cancellation insights: Putler’s RFM analysis helps spot at-risk customers, and filters show products with high refund rates.

- Customer and trial insights: Putler displays the exact count of trial users versus new customers. With filters, you can easily view insights on new customers (including trials) and returning customers.

- Advanced customer profiles: Access detailed information on individual customers, including transactions, orders, refunds, and revenue contributions.

- Comprehensive refund management: Track refunds through a powerful search by name, email, or transaction ID, and initiate refunds with a single click.

- Subscription analytics: Get metrics like MRR, churn rate, and active subscriptions for a holistic view of subscription health.

- Activity Log for quick insights/updates: Putler’s activity log summarizes sales, refunds, and disputes, aiding in quick decision-making and process improvement.

- Geographic segmentation and more: Predefined filters, including geographic segmentation, offer valuable insights for targeted strategies.

The Takeaway

For e-commerce businesses, Stripe payment analytics handles the basics, but to make a real impact, you do need a deeper layer of insight.

Putler steps in to bridge this gap, transforming Stripe’s standard metrics into actionable data that reveals a more complete view of business health.

This makes complex data easier to interpret and supports smarter, data-driven decisions.