In today’s fast-paced and competitive business world, understanding your customers’ behavior is more important than ever.

That’s where RFM analysis comes in – a proven methodology that allows you to segment your customers based on their transaction history and identify your most valuable customers.

By leveraging the RFM framework, you can tailor your marketing efforts to specific customer groups, increase customer retention, and boost your bottom line.

But what is RFM analysis, and how does it work? Let’s find out.

What is RFM analysis?

RFM (Recency, Frequency, Monetary) analysis is a proven marketing model for behavior-based customer segmentation. It groups customers based on their transaction history – how recently, how often, and how much they have purchased.

RFM helps divide customers into various categories or clusters to identify customers who are more likely to respond to promotions and also for future personalization services.

Analyzing RFM is so crucial because it takes into account multiple aspects of customer behavior, rather than just one.

For example, you can say that people who spend the most are your best customers. Most of us agree and think the same.

But wait! What if they purchased only once? Or a very long time ago? What if they are no longer using your product?

So..can they still be considered your best customers? Probably not.

Judging customer value on just one aspect will give you an inaccurate report of your customer base and their lifetime value.

That’s why this model combines three different RFM metrics to rank customers.

If they bought in the recent past, they get higher points. If they buy many times, they get higher scores. And if they spend more, they get more points. Combine these three scores to create the RFM score.

Finally, you can segment your customer database into different groups based on this Recency – Frequency – Monetary score.

Customer segmentation using RFM analysis

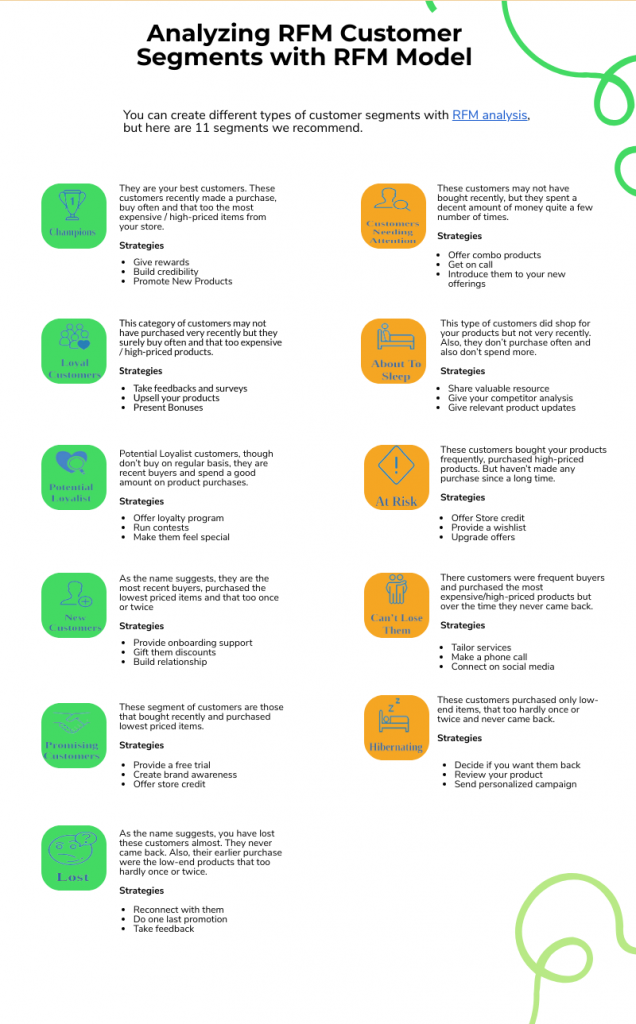

You can create different types of customer segments with the RFM framework, but here are 11 segments we recommend.

Think about what percentage of your existing customers would be in each of these segments. And evaluate how effective the recommended RFM marketing action can be for your business.

| Customer Segment | Activity | Actionable Tip |

|---|---|---|

| Champions | Bought recently, buy often, and spend the most! | Reward them. Can be early adopters for new products. Will promote your brand. |

| Loyal Customers | Spend good money with us often. Responsive to promotions. | Upsell higher-value products. Ask for reviews. Engage them. |

| Potential Loyalist | Recent customers, but spent a good amount and bought more than once. | Offer membership/loyalty program, and recommend other products. |

| Recent Customers | Bought most recently, but not often. | Provide onboarding support, give them early success, and start building relationships. |

| Promising | Recent shoppers, but haven’t spent much. | Create brand awareness, and offer free trials |

| Customers Needing Attention | Above average recency, frequency, and monetary values. May not have bought it very recently though. | Make limitedtime offers, and recommend based on past purchases. Reactivate them. |

| About To Sleep | Below average recency, frequency, and monetary values. Will lose them if not reactivated. | Share valuable resources, recommend popular products/renewals at discounts, and reconnect with them. |

| At Risk | Spent big money and purchased often. But a long time ago. Need to bring them back! | Send personalized emails to reconnect, offer renewals, and provide helpful resources. |

| Can’t Lose Them | Made biggest purchases, and often. But haven’t returned for a long time. | Win them back via renewals or newer products, don’t lose them to competition, talk to them. |

| Hibernating | Last purchase was long back, with low spenders and a low number of orders. | Offer other relevant products and special discounts. Recreate brand value. |

| Lost | Lowest recency, frequency, and monetary scores. | Revive interest with reach-out campaign, ignore otherwise. |

Why email marketing campaigns fail?”

Consider this case…

Carol has put up the perfect email newsletter – content, design, subject line, call to action, social media links… She sends out the newsletter expecting stellar conversion rates. Her mental math reasons that even if it converts at a “low” 10% rate on her 3500 customers, she’d be richer by a few thousand dollars within hours.

Ten minutes.. half an hour.. two hours..8 hours pass. But at the end of the day, it’s only 1.5% of people who clicked the link and a single sale.

Very disappointing, isn’t it?

What did she miss out on?

Carol did everything perfectly, except one – targeting.

She sent the same email to everyone.

I’m sure you’d agree: different customers react to different messaging.

A price-sensitive customer will grab a discount offer, but someone who regularly buys from you may get excited only about a new product launch.

That’s the catch!

Instead of reaching out to 100% of your audience, you need to identify and target only specific customer groups that will turn out to be most profitable for your business.

We are leaving gold on the table…

Most of us are not even close to Carol.

Whether you are in online commerce, retail, direct marketing, or B2B – most of us are so busy with daily chores that we don’t spend enough time on marketing. Our marketing campaigns are hurried, fall short on copywriting, lack professional design, and don’t pay enough attention to tracking or improving conversions.

Of course, we wish to do all of that. But we don’t.

What if we understood our customers a little better and sent them more relevant campaigns?

I promise our success rate will be much higher.

Not only will we make more money, but our customers will also be happier and more loyal.

Still not convinced yet? You will be in a few minutes.

Benefits of RFM analysis: Here’s how analyzing RFM becomes super useful…

Sending a message tailored to the customer group will generate much higher conversions.

Isn’t it obvious?

All marketing campaigns should pick a target segment first, then create promotional material that will resonate with that audience, and then put the pedal to the metal.

Unfortunately, most of us don’t do that.

RFM segmentation readily answers these questions for your business…

- Who are my best customers?

- Which customers are on the verge of churning?

- Who has the potential to be converted into more profitable customers?

- Who are lost customers that you don’t need to pay much attention to?

- Which customers you must retain?

- Who are your loyal customers?

- Which group of customers is most likely to respond to your current campaign?

Proven effectiveness – decades of academic and industrial research

RFM has a decades-long track record. It’s not a fad or a marketing gimmick. It’s a scientifically proven process.

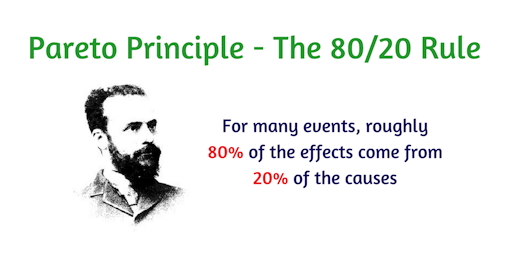

First of all, it’s based on the Pareto principle – commonly referred to as the 80-20 rule.

Pareto’s rule says 80% of the results come from 20% of the causes.

Similarly, 20% of customers contribute to 80% of your total revenue.

People who spent once are more likely to spend again. People who make big-ticket purchases are more likely to repeat them.

Pareto Principle is at the core of the RFM model. Focusing your efforts on critical segments of customers is likely to give you a much higher return on investment!

Roots in direct marketing, database/catalog business

The concept of RFM was originally introduced by Bult and Wansbeek in 1995. It was used effectively by catalog marketers to minimize their printing and shipping costs while maximizing returns.

The rising popularity of computerization made it even easier to perform RFM studies because customer and purchase records were digitized.

An extensive study by Blattberg et al. in 2008 proved RFM’s effectiveness when applied to marketing databases. Numerous other academic studies have also proven that RFM reduces marketing costs and increases returns.

Windsor Circle reported significant success using RFM for their retail customers:

- Eastwood increased their email marketing profits by 21%

- L’Occitane saw 25 times more revenue per email. 25 times, not 25%…

- Frederick’s of Hollywood recorded conversion rates as high as 6-9% in their campaigns

I hope you are now convinced about the usefulness of analyzing RFM for your own business.

Now let’s get on the math behind all those results.

[Simple calculation] How to calculate the RFM score for each customer?

Wondering how to calculate RFM scores for your customer database? Here’s how…

We need a few details of each customer:

- Customer ID / Email / Name etc: to identify them

- Recency (R) as days since last purchase: How many days ago was their last purchase? Deduct the most recent purchase date from today to calculate the recency value. 1 day ago? 14 days ago? 500 days ago?

- Frequency (F) the as total number of transactions: How many times has the customer purchased from our store? For example, if someone placed 10 orders over a period of time, their frequency is 10.

- Monetary (M) as total money spent: How many $$ (or whatever is your currency of calculation) has this customer spent? Again limit to the last two years – or take all time. Simply total up the money from all transactions to get the M value.

RFM analysis example

| Customer ID | Name | Recency (days) | Frequency (times) | Monetary (CLV) |

|---|---|---|---|---|

| 1 | Robert Johnson | 3 | 6 | 540 |

| 2 | Serena Watson | 6 | 10 | 940 |

| 3 | Andy Smith | 45 | 1 | 30 |

| 4 | Tom West | 21 | 2 | 64 |

| 5 | Andrea Juliao | 14 | 4 | 169 |

| 6 | Paul Owens | 32 | 2 | 55 |

| 7 | Sandhya Mhaskar | 5 | 3 | 130 |

| 8 | Joe Woods | 50 | 1 | 950 |

| 9 | Ammar Fahad | 33 | 15 | 2430 |

| 10 | José Barbosa | 10 | 5 | 190 |

| 11 | Salman Desheriyev | 5 | 8 | 840 |

| 12 | Alexander Diesel | 1 | 9 | 1410 |

| 13 | Cheng Liao | 24 | 3 | 54 |

| 14 | Anton Sundberg | 17 | 2 | 44 |

| 15 | Tarun Parswani | 4 | 1 | 32 |

Consider customer Robert Johnson – he last ordered 3 days ago and placed a total of 6 orders worth $540 till date.

Applying the RFM score formula

Once we have RFM values from the purchase history, we assign a score from one to five to recency, frequency, and monetary values individually for each customer.

Five is the best/highest value, and one is the lowest/worst value. A final RFM score is calculated simply by combining individual RFM score numbers.

Remember, RFM values and RFM scores are different. Value is the actual value of R/F/M for that customer, while Score is a number from 1-5 based on the value.

Look at the table below. To calculate the score, we first sort values in descending order (from highest to lowest).

Since we have 15 customers and five scores, we assign a score of five to the first three records, four to the next three, and so on.

For the overall RFM score, we simply combine the R, F, and M scores of the customer to create a three-digit number.

Note: The most recent purchases are considered better and hence assigned a higher score.

| CID | R Value | R Score | CID | F Value | F Score | CID | M Value | M Score | CID | RFM Score |

|---|---|---|---|---|---|---|---|---|---|---|

| 12 | 1 | 5 | 9 | 15 | 5 | 9 | 2430 | 5 | 1 | 544 |

| 1 | 3 | 5 | 2 | 10 | 5 | 12 | 1410 | 5 | 2 | 454 |

| 15 | 4 | 5 | 12 | 9 | 5 | 8 | 950 | 5 | 3 | 111 |

| 7 | 5 | 4 | 11 | 8 | 4 | 2 | 940 | 4 | 4 | 222 |

| 11 | 5 | 4 | 1 | 6 | 4 | 11 | 840 | 4 | 5 | 333 |

| 2 | 6 | 4 | 10 | 5 | 4 | 1 | 540 | 4 | 6 | 222 |

| 10 | 10 | 3 | 5 | 4 | 3 | 10 | 190 | 3 | 7 | 433 |

| 5 | 14 | 3 | 7 | 3 | 3 | 5 | 169 | 3 | 8 | 115 |

| 14 | 17 | 3 | 13 | 3 | 3 | 7 | 130 | 3 | 9 | 155 |

| 4 | 21 | 2 | 14 | 2 | 2 | 4 | 64 | 2 | 10 | 343 |

| 13 | 24 | 2 | 4 | 2 | 2 | 6 | 55 | 2 | 11 | 444 |

| 6 | 32 | 2 | 6 | 2 | 2 | 13 | 54 | 2 | 12 | 555 |

| 9 | 33 | 1 | 15 | 1 | 1 | 14 | 44 | 1 | 13 | 232 |

| 3 | 45 | 1 | 3 | 1 | 1 | 15 | 32 | 1 | 14 | 321 |

| 8 | 50 | 1 | 8 | 1 | 1 | 3 | 30 | 1 | 15 | 511 |

Thus, customers who purchased recently, are frequent buyers and spend a lot are assigned a score of 555 – Recency(R) – 5, Frequency(F) – 5, Monetary(M) – 5. They are your best customers. Alexander Diesel in this case, is not Ammar Fahad – the highest spender.

On the other extreme are customers spending the lowest, making hardly any purchase, and that too a long time ago – a score of 111. Recency(R) – 1, Frequency(F) – 1, Monetary(M) – 1. Andy Smith in this case.

Makes sense, right?

Now let me quickly explain why we made groups of three for each score.

How to calculate the RFM score on a scale of 1-5?

Different businesses may use different methods of RFM formulas for ranking the RFM values on a scale of 1 to 5. But here are the two most common methods.

Method 1: Simple fixed ranges

An example:

If someone bought within the last 24 hours, assign them a 5. In the last 3 days, score them 4. Assign 3 if they bought within the current month, 2 for the last six months, and 1 for everyone else.

As you can see, we’ve defined a range for each score ourselves. Range thresholds are based on the nature of the business. You’d define ranges for frequency and monetary values like this, too.

This scoring method depends on the individual businesses – since they decide what range they consider ideal for recency, frequency, and monetary values.

But there are challenges with such fixed period/range calculation for RFM scores.

As the business grows, score ranges may need frequent adjustments.

If you have a recurring payment business, but with different payment terms – monthly, annual etc – the calculations go wrong.

Method 2: Quintiles – make five equal parts based on available values

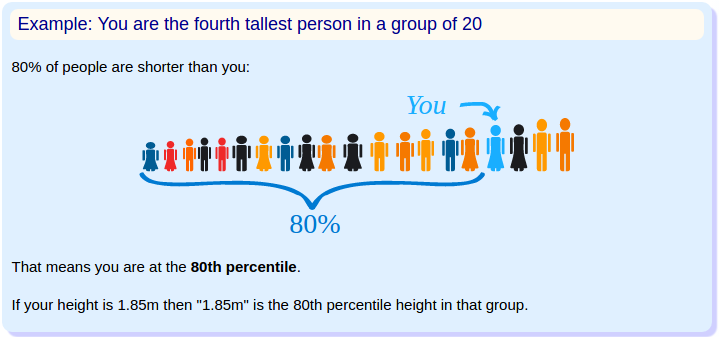

Recall your school days. There was a term – Percentile in maths. Percentile is simply the percentage of values that fall at or below a certain observation.

Here’s a graphic from MathIsFun.com that explains this clearly:

Quintiles are like percentiles, but instead of dividing the data into 100 parts, we divide it into 5 equal parts.

If you understand percentiles, it’s easier to understand quintiles. If we make five equal ranges of percentile, a percentile score of 18 will fall in the 0-20 range, which would be the 1st quintile. A percentile value of 81 will fall in the 80-100 range, and hence, it is the 5th quintile.

This method involves slightly complicated math but solves a lot of problems in the fixed range method. Quintiles work with any industry since ranges are picked from the data itself, they distribute customers evenly and do not have crossovers.

Quintiles are our recommended method to calculate RFM score. We use quintiles for creating RFM segmentations in Putler – our business analytics and marketing insight solution for online merchants.

RFM calculations summary

Take your customer data and give a score from 1-5 to R, F, and M values. Using quintiles works best since it works for all businesses and adjusts according to your data.

Visualizing RFM data

A graphical representation of RFM will help you and other decision-makers understand your organization’s RFM analysis better.

R, F, and M have scores from 1-5, there are a total of 5x5x5 = 125 combinations of RFM value. Three dimensions of R, F, and M can be best plotted on a 3D chart. If we were to look at how many customers we have for each RFM value, we’d have to look at 125 points of data.

But working with 3D charts on paper or a computer screen is not going to work. We need something in two dimensions, something easier to depict and understand.

A simpler representation

In this approach, we plot frequency + monetary score on the Y-axis (range of 0 to 5) and recency (range of 0 to 5) on the X-axis. This reduces possible combinations from 125 to 50.

Combining F and M into one makes sense because both are related to how much the customer is buying. R on the other axis gives us a quick peek into re-engagement levels with customers.

Consider a subscription business for example. For a customer with a monthly subscription of $100, their monetary value will be $1200 for the full year, but the frequency will be 12 owing to monthly billing.

On the other hand, a non-recurring business, or annual subscription at $1200 indicates good monetary value but the frequency is only 1 due to a single purchase.

The customer is equally important in both cases. And our approach of combining frequency and monetary scores gives them equal importance in our RFM analysis for customer segmentation.

Making it more effective – creating RFM segments

Understanding 50 elements can still be tedious. So, we can summarize our analysis into 11 segments to understand our customers better.

If you recall, we discussed these segments at the beginning of this article.

Here’s a table that explains how you can create 11 customer segments based on RFM scores.

| Customer Segment | Recency Score Range | Frequency & Monetary Combined Score Range |

| Champions | 4-5 | 4-5 |

| Loyal Customers | 2-5 | 3-5 |

| Potential Loyalist | 3-5 | 1-3 |

| Recent Customers | 4-5 | 0-1 |

| Promising | 3-4 | 0-1 |

| Customers Needing Attention | 2-3 | 2-3 |

| About To Sleep | 2-3 | 0-2 |

| At Risk | 0-2 | 2-5 |

| Can’t Lose Them | 0-1 | 4-5 |

| Hibernating | 1-2 | 1-2 |

| Lost | 0-2 | 0-2 |

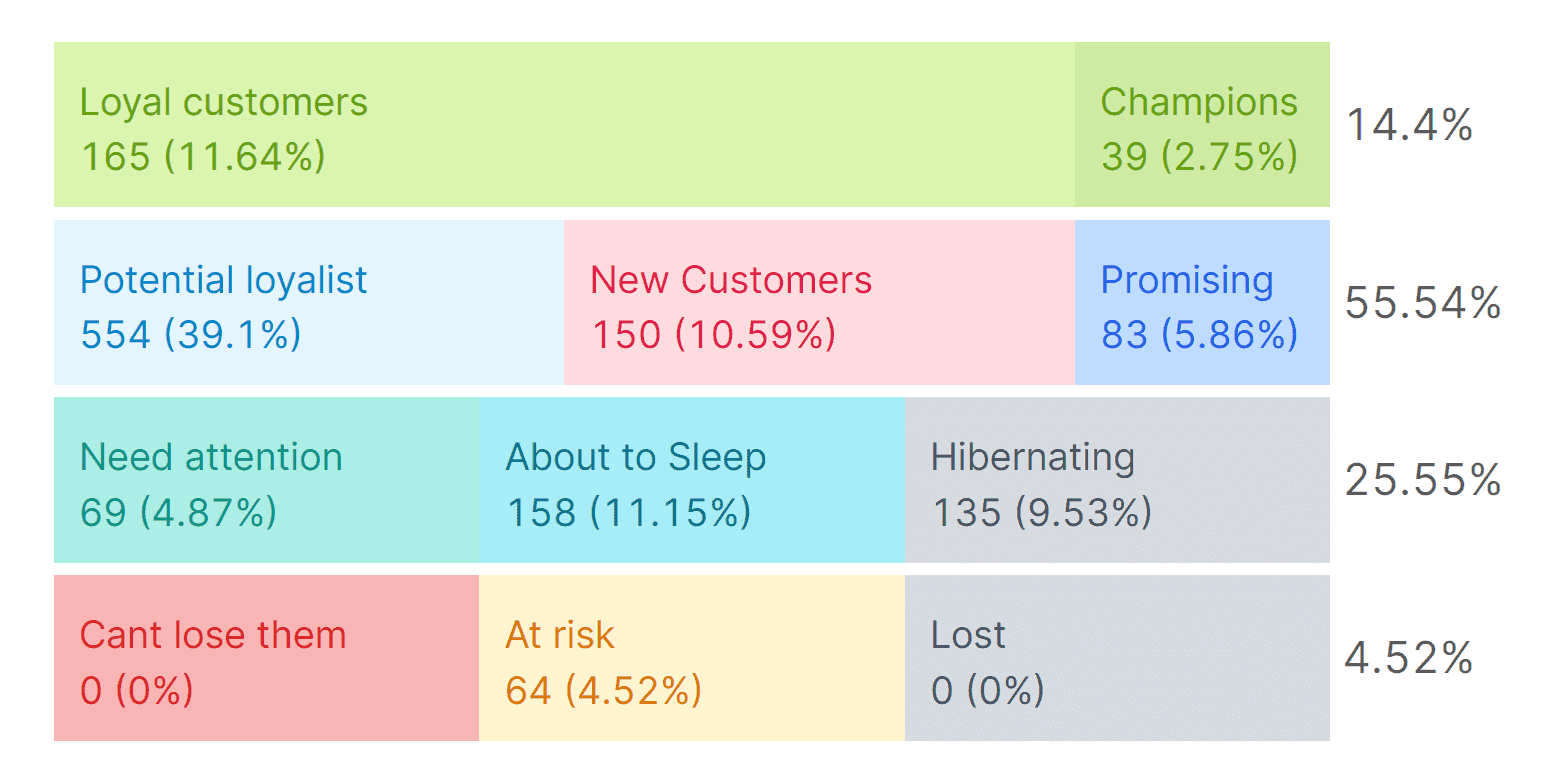

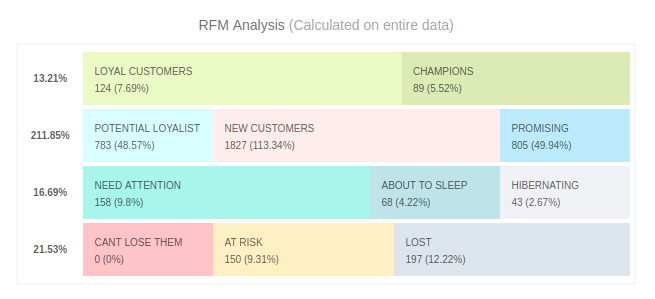

Our ultimate RFM analysis presentation

Giving a distinct color to each segment will allow easier recall. And if we select colors wisely, our pictorial representation of RFM will be much easier to share and understand.

So here’s our final RFM summary report!

Software/Tools for RFM segmentation and analysis

With an increasing focus on customer relationship management (CRM), RFM has become an integral part of marketing and business analytics. If you are doing a one-off evaluation of your customers’ shopping behavior, you can get away with performing a manual or semi-automated RFM analysis.

But if you have a slightly large database, you don’t want to do all the complex calculations yourself.

RFM calculations using Excel

Bruce Hardie and Peter Fader wrote a detailed note about using Excel to calculate RFM scores. They also have a sample Excel file that you can use. But this note is from 2008 and may need updates.

There is also an Excel template from UMacs Business Solutions that sells for $3.99.

There is a walkthrough for setting up RFM segmentation in Excel on CogniView’s site as well.

Another resource I stumbled upon was by Dave Langer, a data analytics enthusiast. Here is a brief video on how he performs RFM calculations using Excel.

Some CRM tools do RFM

There are many CRM software that can automatically calculate RFM scores and segment your customers. Check with the CRM of your choice if they already have RFM support.

RFM segmentation using Python / R and other analytics tools

R and Python are popular for statistical and business analytics. If you have your own data science team, it would be best to create a custom RFM framework for your business using your existing tools.

RFM segmentation for Shopify, BigCommerce and TicTail

RetentionGrid is a software service specialized in analyzing RFM. It can bring in data from your Shopify, BigCommerce, or TicTail store and show beautiful visualization of RFM segments.

RFM analysis and much more for all online stores

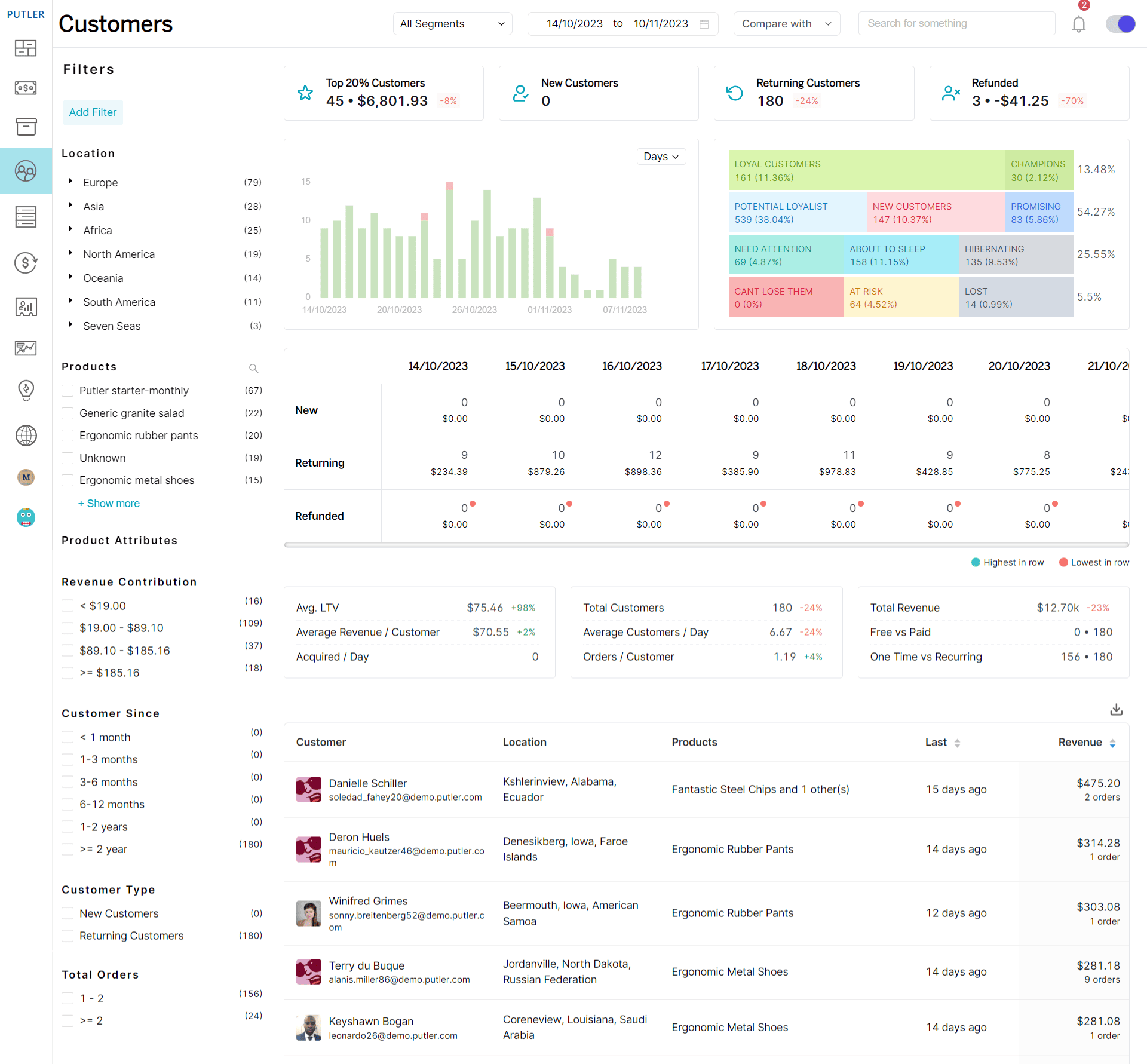

Putler provides comprehensive RFM analysis and gives you many other business analytics and reporting tools.

It’s built for e-commerce and supports automatic sync with major payment gateways and e-commerce systems. Putler also gives you detailed reports on a whole lot of other things – sales, products, and visitors.

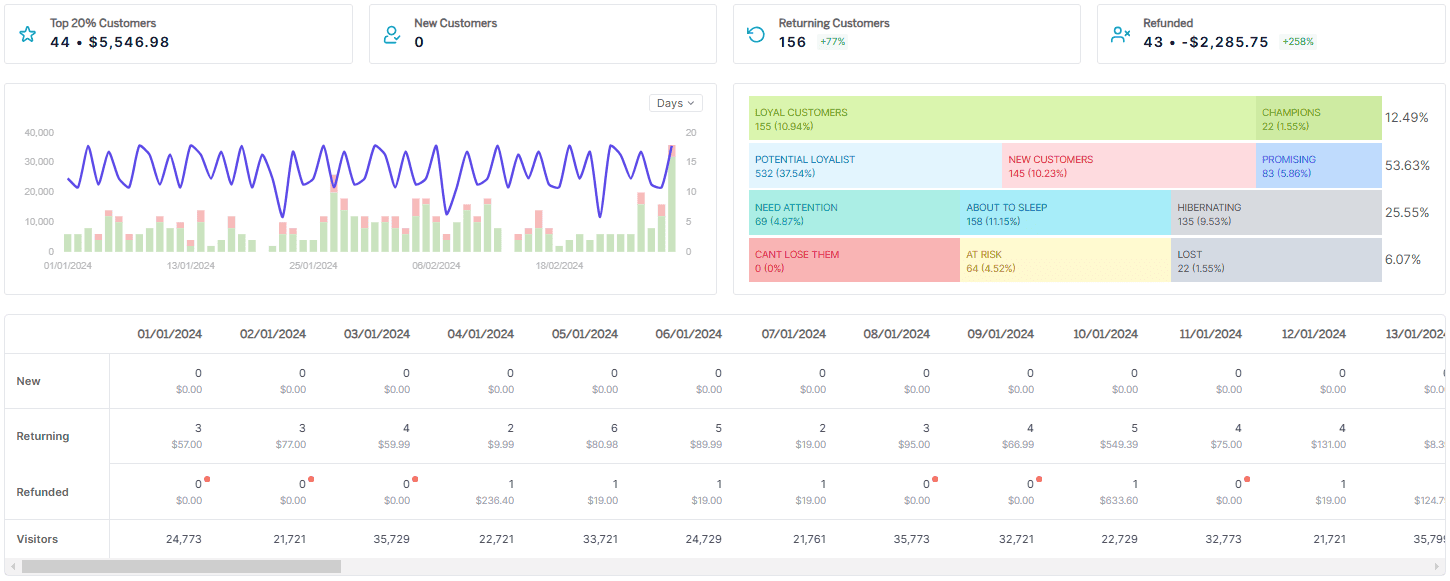

RFM analysis in Putler is available in the customer dashboard. Here’s how it looks.

RFM analysis in marketing

Putler’s RFM analysis helps marketers find answers to the following questions:

- Who are your best customers?

- Which of your customers could contribute to your churn rate?

- Who has the potential to become valuable customers?

- Which of your customers can be retained?

- Which of your customers are most likely to respond to engagement campaigns?

Variations of RFM model

RFM is a simple framework to quantify customer behaviour. Many people have extended the RFM model and created variations.

Two notable versions are:

- RFD (Recency, Frequency, Duration) – Duration here is time spent. Particularly useful while analyzing consumer behavior of viewership/readership/surfing-oriented products.

- RFE (Recency, Frequency, Engagement) – Engagement can be a composite value based on time spent on a page, pages per visit, bounce rate, social media engagement, etc. Particularly useful for online businesses.

You can perform RFM Segmentation for your entire customer base or just a subset. For example, you may first segment customers based on geographical area or other demographics and then by RFM for the historical, transaction-based behavior segments.

Our recommendation: start with something simple, experiment, and build on it.

Applying RFM customer segmentation to your business

Marketers have used RFM-based segmentation to optimize their return on investment in marketing campaigns for years. This is typically done by sending targeted messages to those 11 segments we discussed earlier – or any other custom segmentation that the situation demands.

Customer/User segmentation isn’t something that is alien in the marketing world. The big brands have this down to a T, and the little guys are just waking up to the power behind having a laser-focused strategy – laser-focused on user segmentation.

Neil Patel on how user segmentation works in content marketing

RFM for better email marketing

Create segmented lists in your email marketing software (MailChimp, Campaign Monitor, etc) from RFM analysis. Then run an automatic drip campaign on each segment. If possible, automate moving people between segmented lists as they move from one RFM segment to another.

You can further segment based on open and click rates and products purchased. This gives you laser-focused, highly relevant market segments. This strategy drastically improves results.

RFM to improve customer lifetime value

How much a customer spends with you during her lifetime is based on a number of factors. RFM can assist in many of those aspects – reducing churn, offering upsells and cross-sells to segments that are more likely to respond, increasing loyalty and referrals, selling-high ticket items, and more.

One word of caution though. Do not go overboard. If you keep sending marketing campaigns to one segment of your customers, they may get irritated and stop buying.

RFM segmentation for new product launches

Promoting new products to loyal customers is a great way to get initial traction and feedback. You can contact your champions and loyal customers even before building a product. They can provide you with great insights into what to build and how to promote it. This group of people will also happily refer your product to their circles of influence.

RFM to increase loyalty and user engagement

If you run a loyalty program, Potential Loyalist is the first segment you may target. You want to make sure their initial experience with your product and service is pleasant and memorable. Follow up with a few timely promotions, and they are highly likely to buy again. Sending educational content to these customers will also increase their engagement with your brand.

RFM to reduce customer churn

At Risk and Hibernating are two segments that you need to pay special attention to. Send personalized emails or calls to reconnect with these customers. You may even offer repeat purchases at a discount or run surveys to address their concerns before you lose them to competitors/alternatives.

RFM to minimize marketing costs and improve ROI

Un-targeted marketing campaigns can be expensive. Focusing on a smaller segment of customers will significantly reduce costs, allow you to do more experimentation, and make decisions based on data.

RFM originated in direct marketing, helping reduce printing and shipping costs by targeting customers most likely to respond. So, whether you are doing digital marketing, print, or media, segmentation will reduce your costs and improve your return on investment.

RFM for remarketing/retargeting campaigns

Remarketing is a smart technique where you show your ads/promotions to people who’ve been to your site at least once – but are now on some other site. They will see your ads on the other sites they visit – this improves click rates and overall effectiveness.

A simple way to use remarketing with RFM can be to export a segment of your customers – especially the Recent Customers or Promising ones – to Facebook Audiences or other campaign management solutions you are using. Then show promotions to that group of people.

RFM to understand your business better

Most small businesses do not fully understand their customers. They may not know their customer demographics or firmographics. Collecting and understanding this information can also be time-consuming and costly.

RFM analysis becomes a quick method to understand your customers’ behavior. And since it is based on actual transaction history, it’s much. Looking at different RFM segments can reveal insights about your own business. Asking questions about how your segments compare to each other can open up huge opportunities for growth.

How to use RFM analysis – practical strategies

Now that you know how to analyze RFM, you must be thinking about how to put the RFM segments to use, right? Well, there are a number of ways you can do that. Take a look at what strategies you can implement for each of the 11 RFM segments-

RFM Analysis FAQs

What is RFM segmentation?

RFM Segmentation is a method of segmenting customers based on their buying behavior. While analyzing RFM segments, customers are scored based on three factors – Recency, Frequency, and Monetary Value. It groups customers based on their purchase history – how recently, with what frequency, and of what monetary value did they buy.

Why would a company use RFM analysis?

Companies can analyze RFM to segment customers, send out targeted emails, improve customer relationships, increase ROI, improve marketing, reduce marketing costs, better retargeting, reduce churn, and a lot more. Explore these practical applications in-depth here.

Summary of RFM segmentation – pros, cons, recommendations

RFM technique is a proven marketing model that helps retailers and e-commerce businesses maximize the return on their marketing investments.

Advantages of RFM Segmentation and Analysis

- RFM is useful for different types of businesses – online, retail, direct marketing, subscriptions, non-profits…

- You get to know different customer segments and can identify your best customers

- RFM helps craft highly targeted marketing campaigns

- It aids customer relationship marketing and customer loyalty

- Combine it with other tools to get detailed customer analytics and customer insights

- RFM reduces marketing costs due to optimized targeting

- It decreases negative reactions from customers due to controlled targeting

Some Limitations of RFM:

- It may not be useful when most customers are just one-time purchasers

- When you sell just one product and that too only once, RFM may not be suitable

- RFM is historical analysis. It is not for prospects.

- Without a software/tool, calculating RFM scores and segments can be complex

- Sending too many campaigns to one particular segment can upset customers

Run RFM analysis and segment customers within seconds using Putler

RFM looks great on paper, but it gets complicated if you need to implement it from scratch. So you either need to DIY by building an algorithm or consult a marketing agency to do it for you.

In both cases, you lose a lot of time as well as money. That’s where businesses lose interest and give up on RFM segmentation.

Here’s where Putler steps in

Our analytics tool, Putler, has a ready-to-use RFM chart. Once you connect your eCommerce platform and payment gateway to Putler, it automatically processes all customer data and divides them into 11 segments based on recency, frequency, and monetary parameters.

Fun fact: Calculating RFM literally take just 3 steps in Putler.

Steps to run RFM analysis within Putler

- Connect your data sources to Putler

- Go to the Customers dashboard

- Click on any RFM segment. Done!

Here’s how the RFM chart in Putler looks –

Advantages of using Putler’s RFM analysis Over that of Competitors

Saves time

Time is of the essence. We understand that as business owners, your time is precious. And we value it. At Putler, the RFM analysis is 100% automated. You don’t need to do any manual calculations of the RFM score, no dabbling with Excel sheets whatsoever.

Putler will analyze your customer database and divide customers based on their shopping behavior into 11 segments. You need to simply click the RFM segment you want to work on, and Putler will show you all the customers that fall in that segment.

No coding knowledge required

Not every business is backed by an in-house technical team, and we understand that. So we made Putler’s RFM Segmentation super simple.

You require no coding skills to use, understand it. Putler does all the heavy lifting and provides you ready-to-use segments within seconds.

Very affordable

If you had to create an RFM tool from scratch or resort to third-party marketing agencies for segmenting your customers, you would end up spending thousands of dollars. Right? Also, consider that RFM is not the end step.

It is just the start, once you segment customers, you need to allocate a budget to carry out marketing activities like retargeting, sending targeted emails, improving marketing, etc. Meaning you need to spend even more money once you have the RFM segments in hand.

Considering all this, Putler makes RFM affordable for everyone. You just need to opt for the middle plan (Growth – $79/mo), and you can segment your customers for under $80. Steal?

User friendly

RFM analysis has multiple uses. It needs to be accessed by marketers, consultants, support guys, top-level managers, etc. So, in order to cater to all these groups, Putler has made the RFM interface super easy to use and super simple to understand.

Real-time RFM analysis

Putler’s RFM analysis is based on real-time data. That means, as and when a customer purchases something from your store, Putler will run the RFM analysis on the customer and add him/her to an appropriate segment based on the RFM score calculated.

Real-time RFM analysis ensures that all your customers are segmented at any point in time.

Ability to filter on RFM segments

Putler’s RFM analysis divides customers into 11 segments based on recency, frequency, and monetary values. But that’s not it. You can further drill down these segments based on various parameters like – order status, products purchased, customer since, geolocation, pricing, and a lot more.

This ability to further filter customers belonging to a particular parameter helps you narrow the targeting and improve marketing even further.

Try Putler for free

It’s completely your choice – If you have an online business and you want to run the RFM analysis on your customer base and divide them into various segments, then Putler is a great way to start. Putler has a 14 day FREE trial. You get access to all the features (including the RFM segmentation).

Note: The trial will only pull in the last 3 months of data. So you can segment customers who have purchased from you in the last 3 months in the trial version. Once you try the trial and are convinced about the product, pick the Growth plan and Putler will pull in more historic data. You can then run RFM segmentation on older customers as well.

Leave a reply with your comments or questions. And don’t forget to share this article with fellow marketers.

- Data Mining using RFM – an excerpt from a book by Derya Birant and Prof. Kimito Funatsu.

- Nice presentation on RFM customer segmentation by Kamil Bartocha.

- A review of the application of RFM model by Jo-Ting Wei, Shih-Yen Lin and Hsin-Hung Wu

- On YouTube – an introduction, John Miglautsch’s series – part 1, part 2, part 3.

Great article. A question on the graphic for the ultimate final rfm report – if customers are split into quartiles, why is there different numbers of customers in each “group” (eg “can’t lose them” has 68 customers and “at risk” has 1300 or so) ?

Thanks for the appreciation. Based on percentile values of customers, the customer database is divided into eleven different segments. As “Can’t Lose Them” and “At Risk” are completely different segments, the number of customers falling into each of them will also be different.

Great article!

However, could you explain a little bit further for me the way that you divide 11 segments?

Champions: Recency 4-5, Freqency & Monetary combined: 4-5

Loyal Customers: Recency 2-5 , Freqency & Monetary combined: 3-5

Isn’t it overlapped, the champions & loyal customers?

I also wonder why the segment are overlapping. Did you get any answer?

Yes, I also want the answer. Without this issue being solved, this 11 segmentation is impractical.

Hi Herman,

I have replied to the same question asked by Anh Hoang Duc and Lars above.

Have a look. Hope it clears your doubt.

If you consider the part of Loyal Customers segment having recency score from 4-5 on the X-axis (horizontal), the frequency + monetary score on the Y-axis (vertical) doesn’t exceed 4.

Similarly, the part of Loyal Customers segment having the frequency + monetary score from 3-5 on the Y-axis doesn’t exceed the recency score of 4 on the X-axis.

Hence, only the customers having the highest RFM scores from 4-5 fall into the Champions segment.

As a result, the segments don’t overlap and when you view your customer’s data into Putler, you will see different customers in Loyal Customers segment and Champions segment respectively.

Hope this helps.

I’m still having some difficulties with this concept. A score of 23 falls under 3 different customer segments (Loyal Customers, Customers Needing Attention, & At Risk). Which segment does this score ultimately belong to? What about a score of 24 and 25?

First of all, thanks for the great article. This is some really helpful stuff. I’m wondering how I should read combining F + M. Is it simply sorting the results on F and then by M and then applying quintiles? Or is there some other approach I’m missing? Thanks alot for your response! Cheers, Peter

I’m sorry for the question. But when you say “the frequency + monetary score from 3-5 on the Y-axis” you mean it can be the average within the range ((F1 + M5) / 2) = 3; ((F5 + M3) / 2) = 4; ((F4 + M2) / 2) = 3;

or combinations (F3-M3; F3-M4; F3-M5; F4-M3; F4-M4; F4-M5; F5-M3; F5-M4; F5-M5)?

Thanks for the great Article, really helped a lot in understanding customer segmentation.

I have troubles with the practicality of the segmentation of few combinations.

Am I only not seeing it, or is there no Segment for RFM Scores like 414,352,324 etc?

The segments don`t seem to cover all cases. Or after minutes of looking I just don’t see the fitting segment. Can you help?

Great article! but how do you combine Frequency & Monetary Score Range? You say “frequency + monetary score on X-axis (range of 0 to 10) “, but in 11 segment table we didn’t see any score greater than 5. Could you explain your approach? So we can understand well.

thank you very much!

Hi,

Thank you for such great article. I have one question about the quintile method. should it be done on the population number or it should be done on the RFM values. I mean if it is the second, the population get differ in size.

Thanks for the appreciation Sirvan.

Yes, the quintile method is applied on the population number.

Hi there, great article. But instead of trying to explain the score and segmentation, can you write it down for us exactly which score belongs to which segment? That would be very helpful, and it’s only about 120 combinations so I don’t think it’s such a big deal.

Writing 120 combinations isn’t a big deal. But segmenting users into these 120 combinations itself is very messy, confusing and prone to errors. Hence, to avoid that, we made the RFM analysis to give users readymade customer segments so that they can easily target their audiences accordingly.

Hi,

Thanks for the explanations. However, I still don’t understand how you combine Frequency & Monetary Score Range? You say “frequency + monetary score on X-axis (range of 0 to 10) “, but in 11 segment table we didn’t see any score greater than 5. Also , does the 11 segments cover everyone or there are other customers that are left out?

Hey Vinny,

The horizontal axis, X-axis corresponds to the Recency score. The vertical axis, Y-axis indicates Frequency + Monetary score combined.

Both these axes range from RFM scores 0 to 5. And based on these RFM scores, 11 different customer segments are generated. So, no customer will be left out.

Refer this for more details -https://www.putler.com/rfm-analysis/#visuals.

What do you mean by ‘Frequency + Monetary’ combined? If your F score is 4 and M score is 4, is F+M combined 8? If that is correct – would someone with 444 go into Champions or Loyalty segment.

Looks like this is what everyone is trying to clarify. Thanks!

I think you may have misunderstood Vinny’s question. I have the same question so maybe I can elaborate…

Let’s say my score is 245 (R+2 F=4 M=5). The X-axis is simple, 0-5 with me falling at 2(R). But according to this the Y-axis is F+M which for me would be 4+5. So where would I fall? Mathematically I’d fall at 9, rigtht? Though the scale is only 0-5.

When you combine Frequency + Monetary should both have the same weight? Like (F+M)/2?

Thank you for the great article and answers.

what is the exact meaning of combining frequency and monetary??

Does it mean we need to take the average of them???

Thanks for the article.

How is a score of 0 (zero) possible in the customer segment score ranges? Wouldn’t each R F or M score be limited to values of 1, 2, 3, 4 or 5?

In your 11 segment model – values of 0 are applied to Recent Customers, Promising, About to Sleep, At Risk, Can’t Lose Them, and Lost segments.

great article!!

however, as previously mentioned, I am not sure how to calculate the combined F&M score. do i do the F value + M value and then calculate the quartile? in that case, the M value would be more dominant (assuming for most customers the amount paid is bigger than the number of orders). whats the formula here?

thanks!!

Hi,

Great article! I am able to reproduce this.

I just need a little help on some of the segmentations. How is Lost and Hibernating any different? Since the score start at 1 and not 0. So score (1-2 & 1-2) vs (0-2 & 0-2) is equal. Or do I miss a crucial step?

Hi Anish,

Great article, but multiple readers including myself still have an issue with what you really mean by “frequency & monetary Combined score” and how you are getting a particular segment. You are implying addition by your title, and since each score can be as high as five you would have a combined score of 0-10, but for each customer segment that column goes no higher than 5.

So if I had a recency score of 3, I could potentially be in a “loyal customer”, “potential loyalist”, “promising”, “customers needing attention”, or “about to sleep” depending on what my “frequency & monetary combined score” is.

If the customer has frequency score of 3, and a monetary score of 4, is that a “combined score” of 7? What do you do with that since the chart only goes to 5. Do you mean to average the two and get 3.5? How are you actually trying to determine the combined score?

The second issue that is confusing people including myself is it is truly unclear which box a user is in. The R number is distinctly an INTEGER between 1-5, but for a given set of coordinates, you have two or more boxes intersecting. A good example of this is an R of 2 and F+M of 2. That grid coordinate is the intersection of 4 segments (need attention, about to sleep, at risk, and hibernating) and technically a fifth since “lost” is valid for 2 and 2 as well according to your rubric (but is covered up by hibernating). Essentially you can’t land IN a box.

Do you have some excel formulas to help us understand how you actually assign a segment to the RFM scores?

Thanks for this amazing information. Please write more article like this.

Thanks for these explanations, Anish. Good work

which visual must use for showing the Recency of RFM-Model on dashboard in Power-BI?

Where does customer with RFM score 3,3,3 belongs? Loyal, Potention Loyalist or Need Attention? On graph it lay on borders of these 3 segments. Thanks for answer.

Nice blog and clearly explained. I have an observation and a question!!

Observation – The RFM table has same values for individual R-F-M score. I assume this is by mistake, if not please correct my understanding.

Question – This is related to the 11 segment rule table shown above with scale of scores for each segments. Intervals used in each segments, are these lower bound and upper bound inclusive or exclusive. For example Champion (4-5 R Score), in this interval is 4 inclusive/exclusive??

Thanks!!

Hi,

Thank you so much for this superb article!

I have one question about the scoring method, my problem is with long ocurrences of repeated values.

Suppose I’ve 10 customers and the following computed frequency: 1,1,1,1,1,1,1,4,5,6

What would be the proper criteria to split and score the data?

A. Equally in terms of # of elements:

Elements 1, 1 -> Segment 1

Elements 1, 1 -> Segment 2

Elements 1, 1 -> Segment 3

Elements 1, 4 -> Segment 4

Elements 5, 6 -> Segment 5

B. Value based? If so, what should be the proper segment numbers?

Thanks in advance for any help.

Very insightful and amazing content.

The R number is distinctly an INTEGER between 1-5, but for a given set of coordinates, you have two or more boxes intersecting. A good example of this is an R of 2 and F+M of 2. That grid coordinate is the intersection of 4 segments (need attention, about to sleep, at risk, and hibernating) and technically a fifth since “lost” is valid for 2 and 2 as well according to your rubric (but is covered up by hibernating). Essentially you can’t land IN a box.