In simple terms, ARPPU tells you how much revenue you’re generating from each of your paying customers on average. This metric is crucial for making informed decisions about your pricing strategy, marketing efforts, and product development.

Now, you might be wondering, “How can I use ARPPU to grow my business?” Well, we’ve got you covered! We’ll give you actionable tips and strategies that you can apply to your business right away.

Yes, this article covers everything related to ARPPU – definition, formula, mistakes to avoid while calculating ARPPU, ARPPU tool, and ways to grow your ARPPU.

So let’s dive deep into it.

What is Average Revenue Per Paying User (ARPPU)?

Average Revenue Per Paying User (ARPPU) is the average amount of money you make from a paying customer.

ARPPU formula

Example –

If your monthly recurring revenue is $10000 from 100 paying customers, your ARPPU will be $100.

Some may even call ARPPU as Average Revenue Per Account (ARPA).

How is ARPPU Calculated?

Since Average Revenue Per Paying User is calculated based on monthly recurring revenue and active paying customers, you need:

- Net MRR

- Total active paying customers count

How to arrive at the net MRR?

- Include upgrade revenue

- Include existing paying users revenue

- Include revenue earned from new subscriptions (Full price + non-zero discounted)

- Normalize revenue on a monthly basis for annual or quarterly subscriptions

- Deduce revenue lost from downgrades and cancellations

Want to get free from the MRR calculation hassle? – Here’s how.

Getting total paying customers

Include only those customers who have paid you and have active accounts.

Adding the following type of users will end up watering down your monthly average revenue and provide you with a distorted image of how the company is performing. Exclude these following users types::

- Free trials

- Paid trials

- Canceled subscriptions

- Inactive subscriptions

Based on the above conditions, let’s calculate your ARPPU.

From July 1 – July 31 2018; here’s what happens:

- 35 existing customers renew their $100 per month

- 3 customers have paid $1200 for annual plans

- 2 customers pay $180 every quarter

- 5 customers upgrade from $100 to $150 plan

- 5 customers downgrade their $100 plan to $80 plan

- 10 new customers subscribe to $100 plan using 20% OFF coupons

- 5 customers cancel their $100 plan

In the above scenario, revenue from annual and quarterly paid customers needs to be normalized on a monthly basis and then add them to monthly recurring revenue.

- $1200 annual plan customers contribution to MRR will be $300. [(1200/12)*3]

- MRR contribution from customers on the quarterly plan will be $120. [(180/3)*2]

- Existing paying customers contribute $3500 to MRR.

- Upgrades add $250, new customers add $800 to MRR

- Downgrades and cancellations reduce your MRR by $600

3 Common Mistakes in ARPPU Calculation

ARPPU and ARPU are same

As we are analyzing ARPPU metric, there is one more similar metric which is Average Revenue Per User (ARPU). Sometimes businesses get confused by both of these terms and assume both are the same, but they are not! There is a fundamental shift in both metrics.

Average Revenue Per Paying User is calculated as the monthly recurring revenue divided by the total number of active paying customers.

On the other hand, Average Revenue Per User (ARPU) = Monthly Recurring Revenue / All users (paid + free).

Let’s assume you have 100 users, out of which 30 are paying users. And your total monthly recurring revenue is $3000.

So your ARPU will be 3000/100 = $30.

This means one user brings you $30 per month.

Further, calculate ARPPU which is 3000/30 = $300 that means one paying user brings you $300 per month.

This shows a considerable difference between both the values. So, if you are using both ARPPU and ARPU, state them clearly.

ARRPU = Total Revenue / Total users

Instead of considering monthly recurring revenue, people may consider the total revenue earned. But for subscription businesses, it’s the monthly recurring revenue that shows the true picture of your business.

So, in both these cases, the total user count will always be greater than the paying users.

Average check and ARPPU are the same

Another common mistake businesses make while calculating ARPPU is that they take the Average Check as Average Revenue Per Paying User.

That’s wrong!

The result may not be unfavorable but it could misguide the business.

Average Check is an average transaction value and the number of transactions cannot be the same as the number of paying users. If one user pays repeatedly in a month his number of transactions will not be taken in the calculation of Average Revenue Per Paying User but it will be considered in Average Check calculation.

Let us try to understand this with an example.

Assume, 50 users paid $50 each, and later 10 of them again paid $10 each. In this case, the Average Revenue Per Paying User will be (50 x $50 + 10 x $10)/50 = $52.

On the other hand for Average Check calculation, we will divide the revenue by the number of transactions which is (50 x $50 + 10 x $10)/60 = $43

Get Correct ARPPU for your Business

If your business model needs to ascertain the correct ARPPU and you may have made some mistakes as we discussed above what would you do?

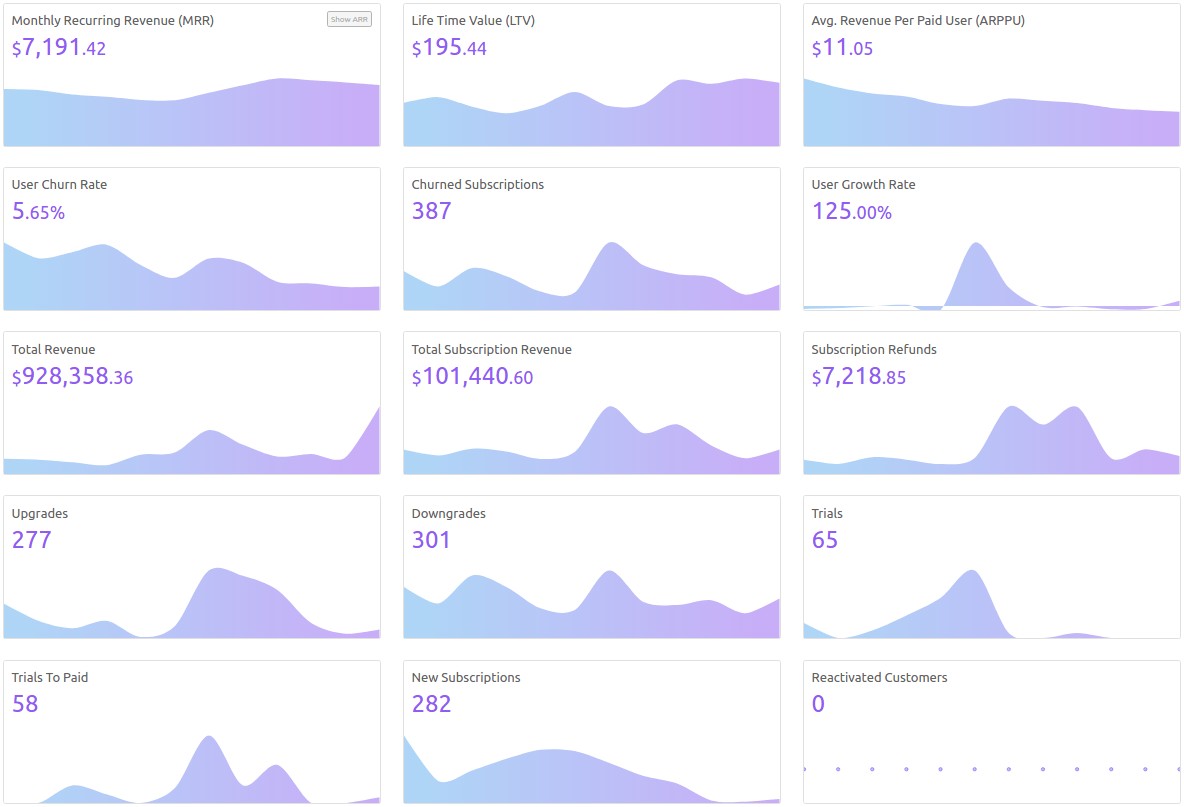

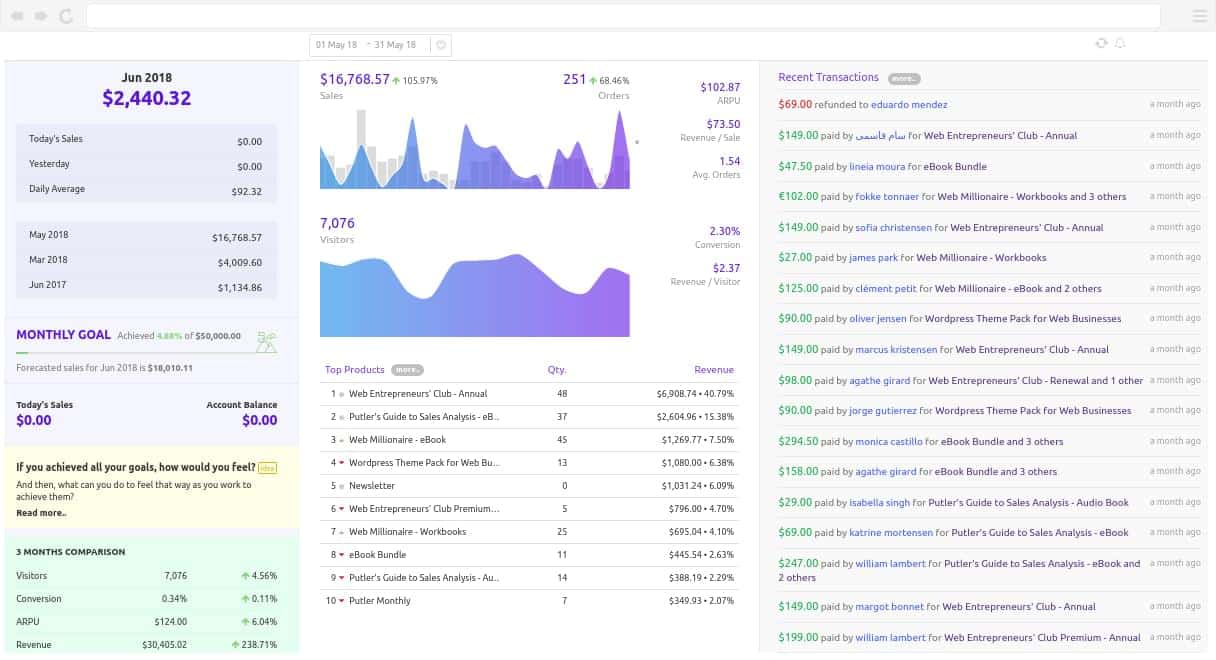

Use Putler which can derive the right ARPPU for your business within a fraction of a time. Not just ARPPU, you also get other valuable subscription metrics such as LTV, MRR, Churn rate and more.

In addition, you get in-depth reporting and analytics related to your sales, products, customers and visitors.

Connect your payment gateways/e-commerce systems to Putler and get a complete picture of your business.

$550 ARPPU…are you kidding me?

The number seems like a dream right? But it’s a reality.

It’s neither any famous tech-giant nor any investment conglomerate that has achieved this. It’s a gaming company Machine Zone, that had achieved this milestone with their game “Game of War” in 2015.

This value is incredible and the game achieved this value with some intriguing tactics. What tactics did they execute? See the excerpt here from the original article.

Of course, a lot of games do stuff like this, and part of Machine Zone’s success is that other studios haven’t figured out how to duplicate its money-making techniques.

Two Factors that Affect your ARPU Considerably

Low price bracket

If you’re charging like $10, $15, and $20 a month, your Average Revenue Per Paying User is going to be pretty low.

A low ARPU means that support, infrastructure, and scaling issues hit you harder, and faster. You’ll face a difficult time staying in business.

Customers migrating to lower or higher value plans

If you offer the majority and beneficial features in your lower plans, customers will be happy to stick to that plans. As a result, you won’t have customers on the higher plans; thus hitting your ARPPU to a great extent.

Why is ARPPU Important?

ARPPU determines loyalty among all users, those who are more loyal will pay you every month. In other words, a higher ARPPU has the potential to fetch more money from existing customers.

Additionally, if you’re able to have a high Average Revenue Per Paying User relative to the value you’re providing or the revenue of the company, you know you have a product that’s driving a better value ratio.

Indicates your business’ financial health

If your ARPPU is low at $50, then you know you need to get a metric ton of customers to grow a sustainable company. This allows you to see what kind of business you need to be from a pricing and value perspective.

A higher ARPPU indicates you’re growing. A lower ARPPU indicates your product doesn’t suit the market.

Indicates whether you’re extracting enough value from your personas

You may be absolutely deflating your ARPPU by targeting too many small, distracting (and expensive) low-revenue customers. If you’re not in the consumer space or a space with hundreds of thousands (if not millions) of potential customers, then you shouldn’t be chasing sub $100/m customers. Make sure you quantify your buyer personas properly and target the right ones for growth.

Validation that your marketing and sales teams are driving the right deals

An increasing ARPPU consistently over time indicates that your sales and marketing value propositions and targeting are constantly getting better time over time. Essentially, you’re becoming more efficient.

How to Increase ARPPU?

Here are the five ways you can optimize ARPPU for your SaaS business:

Increase the price — but wisely and with justification

The most common method to increase ARPPU. But it shouldn’t cause friction with existing customers otherwise more users will churn than an upgrade.

If you are increasing the price, you need to present a strong justification for it. If feasible, do micro price increases; customers won’t complain.

Offer up-sell / cross-sell

Identify key touch points where you can try to up-sell (invite customers to upgrade accounts) or cross-sell (offer additional relevant services if you have them).

Giving a limited free trial run also lets users sign-up for the paid plan before the expiry.

The game here is to analyze past user behavior, determine the key turning points where users are most likely to benefit from an upgrade and make the pitch.

Pitch other valuable products

After establishing a successful customer relationship, you can pitch your other products, and affiliate products that make sense for your user base.

Focus on the cream crowd

With enough experience to deeply understand the market and deliver outstanding value consistently, you can afford to focus on the top 1-2% of clients to attempt to sell special membership offers or high priced services like premium support, customer success management, etc.

Ignore low growth potential customers

Narrow down customer segments that are least likely to progress to high-paying tiers. Allocate more resources towards cross-selling and up-selling to high-growth potential customers, which will have a positive impact on Average Revenue Per Paying User.

Simplify ARPPU Analytics with Putler

Let’s face it, digging through multiple payment gateways, shopping carts, and subscription management systems, just to get to an accurate ARPPU can be a real headache. That’s where Putler comes in!

Putler is a powerful analytics tool that makes ARPPU analytics a breeze. With its easy-to-use interface and advanced features, you can get real-time insights that will help you optimize your pricing strategy and grow your business.

One of the things we love about Putler is its ability to aggregate data from multiple sources. This means you can see a complete picture of your revenue and customer behavior, all in one place. Plus, Putler offers advanced segmentation options, so you can analyze your ARPPU data by product type, location, subscription level, and more.

Putler also offers advanced filtering options, which means you can drill down into your ARPPU data and analyze it in greater detail. You can filter your data by date range, product category, and customer behavior, giving you a more nuanced view of your revenue and ARPPU trends.

But what really sets Putler apart is its ability to generate customer profiles automatically. This means you can see your customers’ purchase history and behavior all in one place, so you can personalize your marketing and engagement efforts to boost retention rates.

However, keep in mind that ARPPU is just one of many metrics that can help you grow your business. By combining your Average Revenue Per Paying User with other metrics like churn rate, customer lifetime value, and customer acquisition cost, you can get a complete picture of your business performance and identify areas for improvement.

At the end of the day, the key to success in the subscription-based model is to focus on providing value to your customers. By understanding your customers’ needs and behavior, you can create products and pricing strategies that keep them coming back for more.

FAQ

What is the difference between ARPU and ARPPU?

ARPU measures average revenue per user, including both paying and free users. ARPPU focuses solely on paying users, providing a more specific metric for revenue from this segment.

How are ARPU and ARPPU calculated?

ARPU is calculated by dividing total revenue by the total number of users. ARPPU is calculated by dividing total revenue by the total number of paying users.

Hi Akshat,

Really an awesome article on ARPPU.

I’m sure its kind of the first metric, topic, on which you have written very well. My compliment again.

Many sites cover RFM, but ARPPU is new to us…

Thanks for the appreciation.

Glad you found it useful.

Also, read our other metric articles on MRR, Churn rate, User growth rate.

Generally ARPPU is the response of exactly paying users to the value that your project carries. This metric shows how much a loyal paying user is willing to pay. It can also be interpreted as a reaction of users to the prices set in the project. If you raise prices, your ARPPU is likely to rise after them. However, this does not mean that you will earn more, as the share of paying users may drop sharply.

Yes. Raising prices may cause churn to increase and we have exactly mentioned that in one of the five strategies to grow ARPPU in this article.

Hence, we suggest doing a micro-price increase and presenting a strong justification for price rise. This won’t let your users churn.

Hi, i think i found a mistake in “ARPPU calculations” section: Thats the calculation is got: 3,500$ + 300$ + 120$ + 250$ -100$ + 800$ -500$ => total 4,370$/65 customers = 67.23$ ARPPU.