Hey there, PayPal buddy!

If you use PayPal for your business, you probably check your transactions with their reports, right? But guess what? It can be a real bummer!

Logging in each time to check your transactions and then waiting for the information to load is like watching paint dry!

And those reports with all the numbers and stuff? They can be super confusing, just like trying to solve a puzzle without any clues.

But guess what? There is a solution to all these problems!

Numerous PayPal-using eCommerce merchants all over the globe are opting for Putler.

Wondering, why?

Well, Putler collects all your data from several sources and presents the most valuable data points. Once you implement these insights in your business, you can see your profits soaring in no time.

And, that’s just to begin with.

So, let’s understand the exact areas where PayPal transaction reports draws you back and how you can make your PayPal experience way cooler!

The importance of PayPal reports

As a business owner, you know the importance of keeping track of your daily activities, especially when you’re running an eCommerce store with PayPal. PayPal’s reports offer valuable insights that can help you make informed decisions for your business.

- Sales and Transaction Insights

With PayPal reports, you can get updates on your sales and transactions. Whether it’s daily, weekly, or monthly, you’ll have a clear picture of your revenue flow and payment statuses. - Product Performance Tracking

If you want to know which products are the real stars in your store, PayPal reports can help. These reports show you the best-sellers, helping you understand which items are most popular among your customers. - Customer Analytics

Knowing your loyal customers is vital. PayPal reports can provide data on your most frequent shoppers, their average spending, and their loyalty to your brand. This information allows you to build better relationships with your customers. - Visitor Behavior Analysis

Your website is your online storefront, and it’s crucial to optimize it. PayPal reports help you analyze visitor behavior, revealing which pages attract the most attention and which ones might need improvement. By understanding visitor interactions, you can enhance the overall user experience.

But, wait, there’s a catch. To make sure you get these insights right, you need to have the right PayPal reports in place.

Let’s find out which reports from PayPal can help you the most.

The in & out of PayPal reporting

PayPal offers a variety of reports to help you keep tabs on your business.

But hey, we know it can get overwhelming with all those categories on their site.

Don’t worry, we’ve got you covered! We’ve handpicked the most important ones that will truly benefit you.

PayPal Monthly Financial Summary Report / Monthly Statement Report

This report gives you a detailed view of all your PayPal transactions.

It’s like having your financial story summarized in one place – customer payments, PayPal fees, business expenses, bank transfers, and more.

You can even drill down to track individual PayPal transactions.

3 Steps to Generate Your Monthly Statement:

Here are the three steps to generate your monthly statement:

Select a time periodThe default option is the current month. You can set a maximum of 31 days range only that too, excluding the current day.Select a currencyfrom the drop-down to choose your preferred one. You can only view transactions in a single currency at a time.- Click

View Reportto generate your report.

To view the report currently or later, you have the option to open and save it either in PDF, Excel sheet, CSV export, or tab format.

PayPal Transaction Details Report

PayPal’s transaction details report provides a treasure trove of information about each PayPal transaction in your account, whether they’re pending or completed orders. Plus, you’ll get details on shipping status and PayPal Seller Protection availability.

Moreover, if you want to search for a particular transaction, you can do so by viewing it in PayPal transaction history, thanks to PayPal’s search algorithms. The search results are also quite detailed and informative but they take a considerable amount of time to load.

3 Steps to Generate Your PayPal Transaction Details Report:

Here are the three steps to generate your PayPal transaction report:

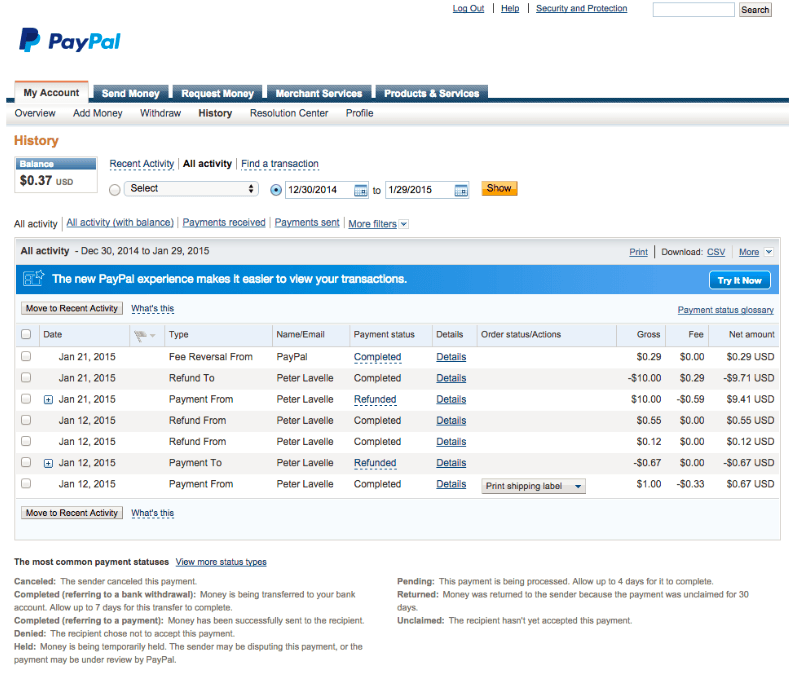

- Go to

MyAccount>History>All Activity Select the date rangeyou want to view the transactionsClick on Show

The report includes information on individual PayPal transactions made on any given day within the last 45 days. Read the transaction detail report specifications to understand it better, including report format, file structure, and more.

PayPal Settlement Report

The PayPal Settlement report keeps you informed about transactions that impact your fund settlements. It’s like having a backstage pass to see the transaction event codes and initiation dates.

PayPal Case Report

Previously known as the Downloadable Dispute Report (DDR), this one keeps you informed about any claims, disputes, or chargebacks made against your PayPal accounts.

These reports can be used as backup records during audits, applicable in cases, such as tax payments.

Other PayPal Reports Include:

- Revenue Share Report

- Recurring Payments Profile Report

- Subscription Agreement Report

- Pre-approved Payments Agreement Report

Order Report (ORT)

Imagine your online store is thriving; orders are flowing in, but some are stuck in an “almost paid” status. Frustrating, right? The PayPal order report can help you in this situation.

This report helps you track orders that customers have approved but haven’t fully processed yet. There can be various reasons for this, such as funds being held by banks, shipping issues, technical glitches, and more.

The ORT provides detailed information on every pending order, each identified by a unique ID. This includes customer details (PayPal account ID, email, and name), Ccurrency details, shipping information, and any custom fields.

The Revenue Share Report provides partners detailed insights into the revenue share received from merchant activities. It includes comprehensive summaries of debits, credits, and balances for each currency held in your accounts.

NOTE: Access to the Revenue Share Report is limited to selected business accounts approved by PayPal.

When a PayPal account manager activates the Revenue Share Report for a partner, the partner can also create a user account for accessing the Secure FTP Server. For security reasons, users are required to generate their own usernames via a dedicated page on the main PayPal website.

Recurring Payments Report

If you’re running a subscription-based service and you need to keep track of all the upcoming payments from your subscribers, the Recurring Payments Profile Report (RPP) is your go-to tool for this task.

This report shows your account ID and the subscriptions’ starting and ending date.

The RPP can be accessed via PayPal’s website and Secure FTP Server. It’s specifically designed to provide comprehensive information as defined in the Secure FTP Server Specification.

If you are still curious, you can go through this article to learn more about PayPal reports in detail.

But prior to that, you need to have a good understanding of how to get your hands on these vital PayPal business reports.

Let’s find out.

How to find and download PayPal reports

It involves some steps for you to access and download your PayPal reporting. Here they are:

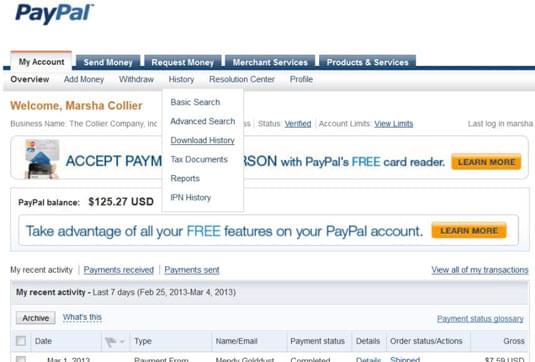

Step 1 – Log in to your PayPal account and click on the tab labeled My Account displayed at the top of your page.

Step 2 – Within this tab, you will see the ‘History‘ item. Click Download History on the drop-down menu after you mouse over the history item on the navigation bar.

Step 3 – Scroll down to indicate the level of your account’s customization. Then click on the customize download link to take the page to where you can further refine the PayPal reporting data.

Step 4 – Select the fields that you would like for inclusion in the customization of the reporting data by marking the checkbox next to the desired data, and clicking Save. You will then return to the download history page.

Step 5 – Specify the date span in which you want the downloaded reports taken.

Step 6 – Select a format from the file types of the download drop-down list for your downloaded reporting.

Step 7 – Finally, click the Download History button, and in a few minutes, your file will be ready to download.

Once done, you will be able to view the downloaded PayPal statements and reports.

So, now that you know which PayPal reports to download and how, you need to understand that there’s a lot more that you can do to boost your eCommerce store revenues.

Let’s find out why PayPal is not enough to give you that extra push.

Common PayPal reporting challenges faced by eCommerce businesses

Despite PayPal’s reporting endeavors, most eCommerce businesses encounter significant challenges that hold them back from reaching their full potential.

You see, PayPal is a payment platform, not a dedicated reporting platform. While it delivers data, its reports may not fully address the unique needs of businesses looking to leverage that data strategically.

Let’s delve into these major pain points that arise from the limitations of PayPal analytics and reporting:

- Limited Customization

PayPal’s built-in reports have limited customization options, leaving businesses struggling to extract the specific data they need. Every business is unique, and one-size-fits-all reports might not suffice for your specific requirements. - Incomplete Data Visibility

PayPal reports might provide a basic overview, but they often lack in-depth data visibility. As your business grows, you require more comprehensive insights to make well-informed decisions. - Tedious Manual Analysis

Analyzing PayPal reports manually can be time-consuming, especially for businesses with a high volume of transactions. Spending hours crunching numbers steals precious time that could be better utilized in strategic planning and growth. - Complex Data Interpretation

For many eCommerce merchants, understanding the complex numbers and jargon in PayPal reports can be overwhelming. Deciphering the data becomes challenging, hindering their ability to identify valuable trends and patterns. - Integration Challenges

eCommerce businesses often use multiple platforms and tools to manage their operations. Integrating PayPal data with other systems can be tricky, leading to fragmented insights and an incomplete understanding of the business’s overall performance. - Limited Support for SaaS Companies

SaaS (Software as a Service) companies have unique needs when it comes to reporting and analytics. PayPal’s standard reporting may not cater to their specific requirements, making it difficult for SaaS businesses to gain the insights they need to optimize their operations.

These issues are not just limited to PayPal sales reports. eCommerce vendors encounter more such issues in every other payment platform.

Payment platform reports are pretty efficient when it comes to delivering payment information. Period.

But do those traditional reports help eCommerce businesses enough? The straight answer is NO!

Certain operational problems come with traditional payment platform reports, including:

- Very Slow Transactions Loading

When you want to see your transactions on a payment platform, it often takes too long to load. Waiting for a minute each time can be frustrating, especially if you have a lot of transactions. - No Instant Searches

Searching for specific details, like client names or emails, is not quick on some payment platforms. It can take a while to find the information you need. - Complex Reports

The reports from payment platforms can be confusing, especially if you’re not used to reading such data. It’s not easy to understand what it all means. - Limited Insights

Some payment platforms may not provide all the detailed insights you want. You might need more information to make better decisions. - Difficult to Access

Finding and downloading reports on some payment platforms can be tricky. Applying filters and getting specific data can be a hassle. - Limited Time Range

Reports on certain payment platforms may only go back up to a limited number of days, and you can’t see data beyond that period. - Missing Products & Customer Insights

You won’t find important information about your best-selling products or your most loyal customers in some payment platform reports. - Lack of Sales Insights

Certain payment platforms may not provide insights like peak sales periods, which countries bring in the most sales or your daily average revenue.

There is no doubt that PayPal and other payment platforms provide a solid foundation for financial transactions. However, to overcome these reporting challenges, eCommerce businesses need a more advanced and tailored approach.

Why choose Putler as your ultimate PayPal reporting solution?

Speaking of smart tools for your payment reports, you need something to access the metrics and statistics to make the right decisions and boost your business’s growth.

But, what if there was a tool that could not only improve your payment reports but consolidate your data from all digital platforms?

Wouldn’t it be great if you could view all the important data and insights on one dashboard and make the best decisions in the blink of an eye?

Well, here it is.

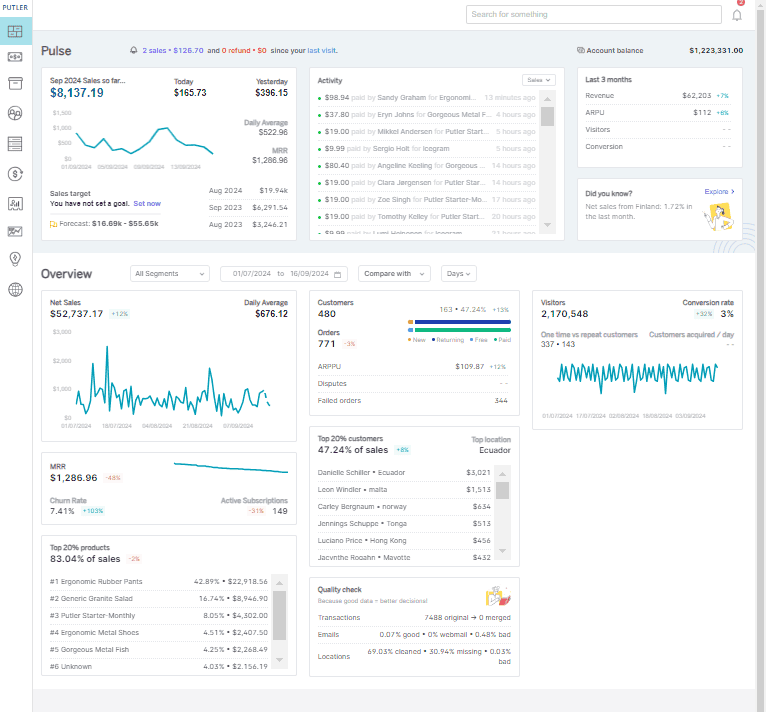

Putler is a game-changing tool that revolutionizes how you manage your eCommerce transactions and gain valuable insights about your online business.

What makes Putler stand out as the best PayPal reporting tool? Let’s explore its exceptional features:

Automatic sync with payment platforms

Simply enter your payment platform API details, and Putler takes care of the rest. It automatically downloads the latest transactions and updates all statistics seamlessly. Here are the payment platforms that Putler connects with to consolidate your data –

- PayPal

- Stripe

- 2Checkout

- Braintree

- Authorize.Net

- SagePay

- Razorpay

The benefits it brings

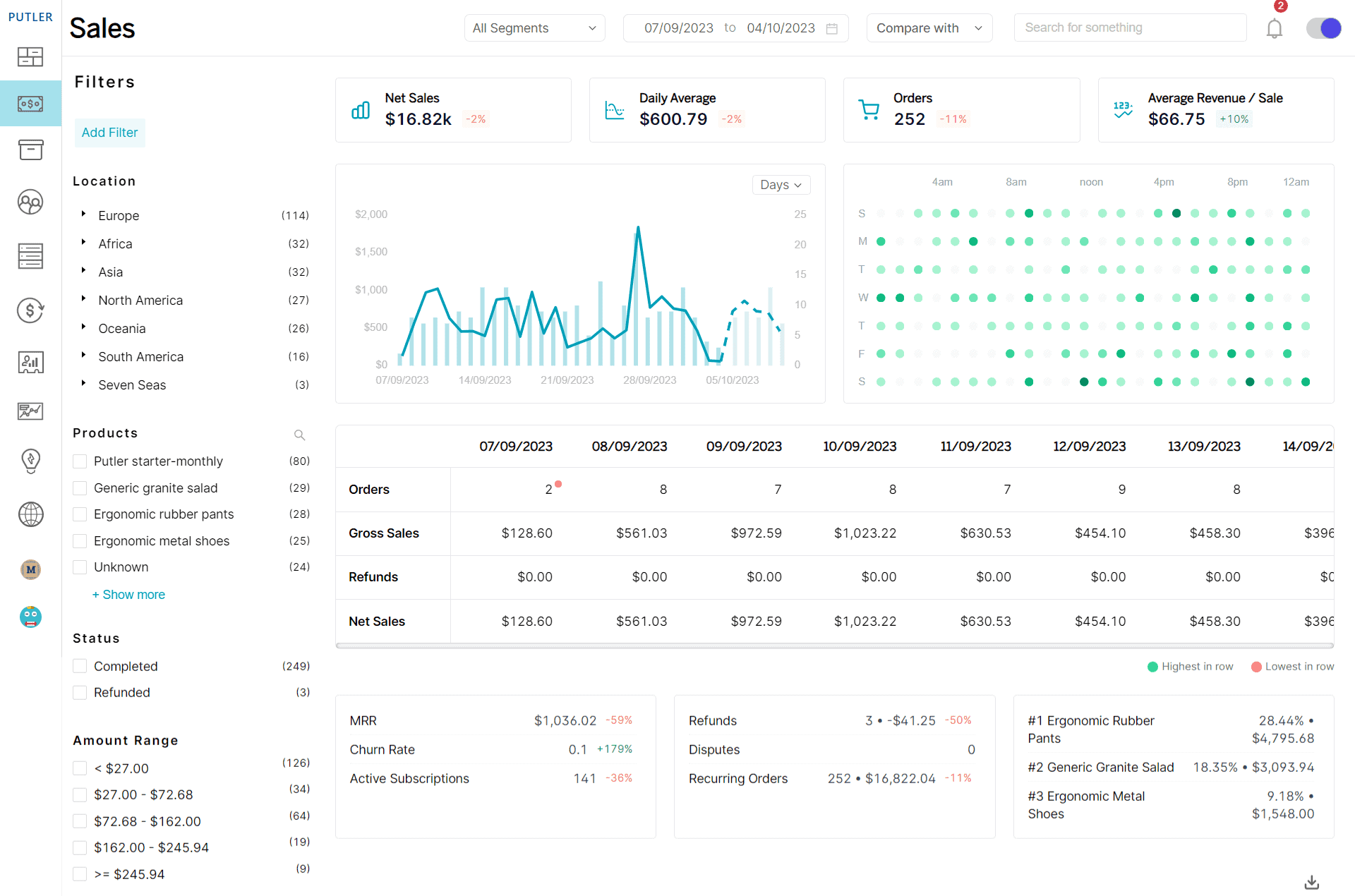

- Learn about monthly recurring revenue (MRR), daily average revenue, monthly revenue, sales forecast, and more to acknowledge your business revenue generation capacities.

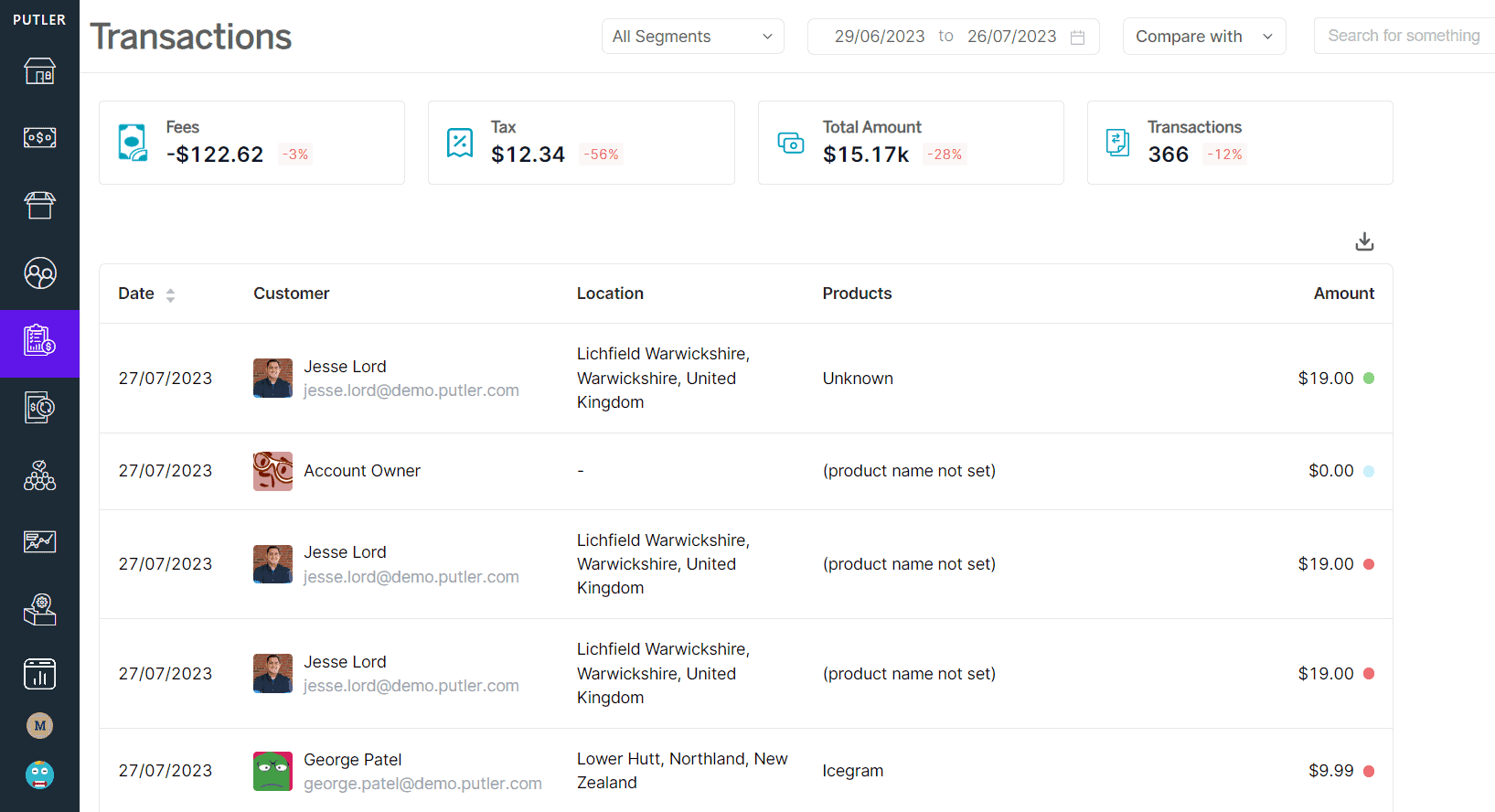

- Access the transaction list related to sales, refunds, disputes, and more to understand your sales frequency and customer interest in your product.

- Drill deeper into your transaction reporting by applying filters, such as location, products, transaction status, etc. The transaction dashboard displays information about your taxes,

platform fees, and more.

Instant reports & business overview

With Putler, you get instant updates and reports without the need to log in to your payment platform repeatedly or wait for reports to load every time. Here are some of the reports that Putler will provide you with –

- Sales Reports

- Customer Reports

- Order Reports

- Product Reports

- Subscription Reports

- Insight Reports

- Multi-store Reports

- Automatic Data Aggregation

Putler shines as an aggregator, gathering data from various payment gateways, shopping carts, and other synchronized accounts. This means you get a unified report on your business or sales from one convenient source.

So, no matter where your data is, Putler can get it for you. In fact, to make things easier, Putler has also introduced Putler Web Analytics, which is a more privacy-focused, simpler, and smarter alternative to Google Analytics.

The benefits it brings

- Acknowledge net sales, gross sales, order frequency, and more to overview your business performance.

- Know your loyal customers and release loyalty programs to further increase sales and engagement.

- Catch the attention of new customers, potential loyalists, and other customers with eye-catching discounts and offers.

For instance, take a look at this case study where Putler helped Nicolai Grut, owner of Grut brushes, streamline their data. The comprehensive data analysis on a single dashboard enabled Nicolai to make better-informed decisions.

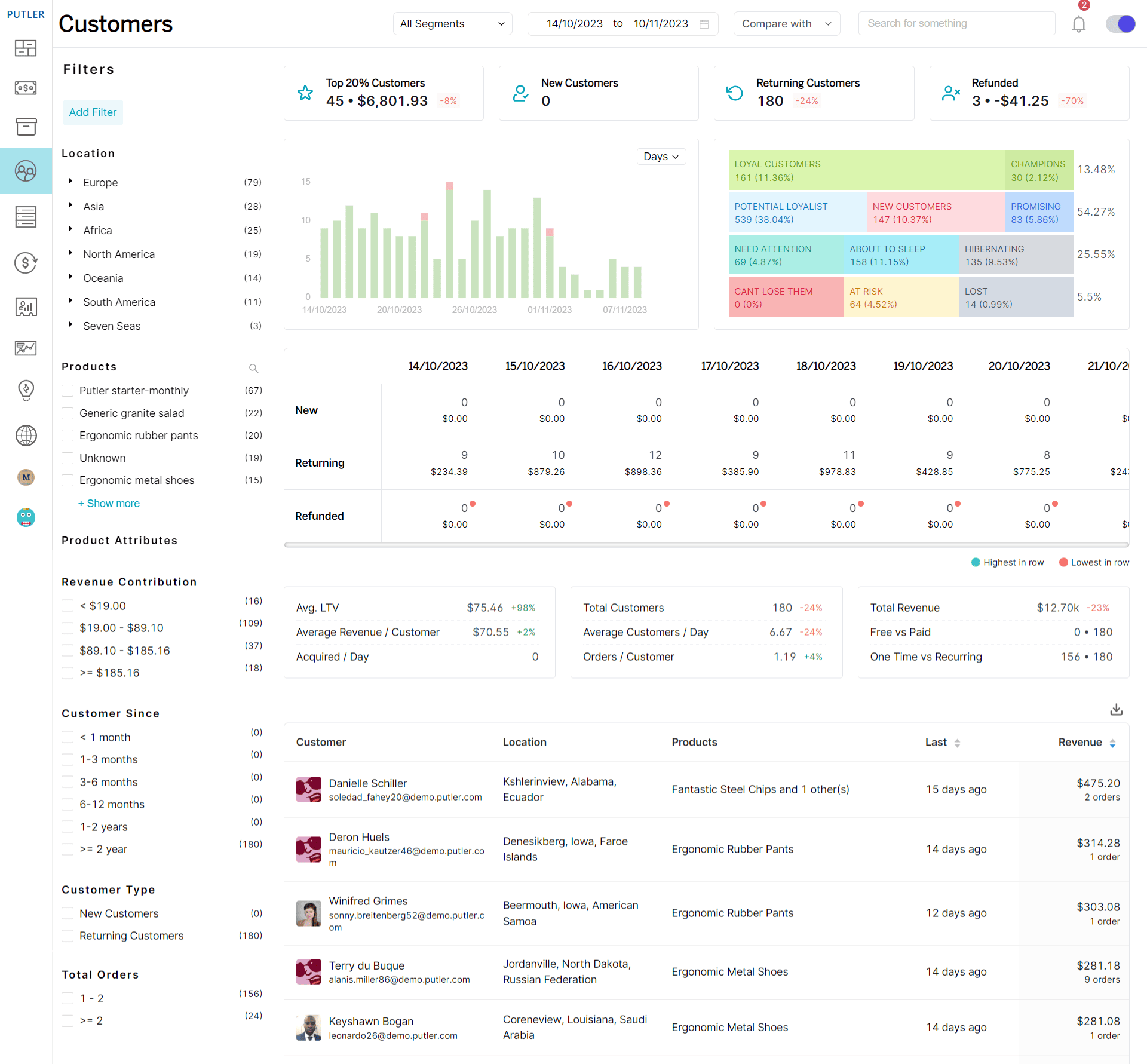

Built-in Customer Segmentation:

Putler’s customer dashboard gives you all the vital information you need about your customers. Its RFM analysis further provides details on different customer segments, their loyalty, profitability, and more. This analysis is a game-changer for enhancing your relationship marketing. Click here to understand how you can use RFM analysis to make the most out of it.

The benefits it brings:

- Use the feedback you gather from the detailed analysis to strengthen your brand’s credibility and cultivate a robust partnership with your customers.

- Take steps to ensure more customer engagement with the brand and instill confidence and loyalty in your customers.

Take the example of KLM Royal Dutch Airlines. They use customer segmentation (behavioral) to provide benefits to its frequent flyers. They allow frequent flyers to earn miles in various ways, including renting a car, booking a hotel, flying with KLM & its partners, etc. The number of miles depends on the ticket price and elite status level. The higher the level, the more points customers get.

As a result, this keeps the customers engaged and prevents them from switching to other airlines.

Lightning-Fast Transactions on Board

Putler loads transactions in a fraction of a second, unlike some payment platforms that can take minutes. Speed and efficiency at its best!

The benefits it brings

- Accessing and interpreting instant customer data enables you to improve visibility and control and allows for quick decision-making for better financial exchange.

- Instantly identify irregularity or suspicious activity and take prompt actions.

- Handle large transactions efficiently in one place as the business grows.

For example, Adobe’s data-driven approach is the perfect example of the power of data. With the right data analysis, Adobe could transform its traditional business licensing to a cloud-based subscription service.

Intuitive search

Putler’s search feature is top-notch. It enables you to search for the customer and product details.

For example, when you search for any product, you get all the information regarding revenue, sales, orders, refunds, customers who bought the product, and more.

The benefits it brings

- Find specific customer or product details from the sea of information, allowing you to adjust your strategies based on real-time data.

- Empower you with new opportunities, allowing you to grab new market opportunities and stay ahead of the competition.

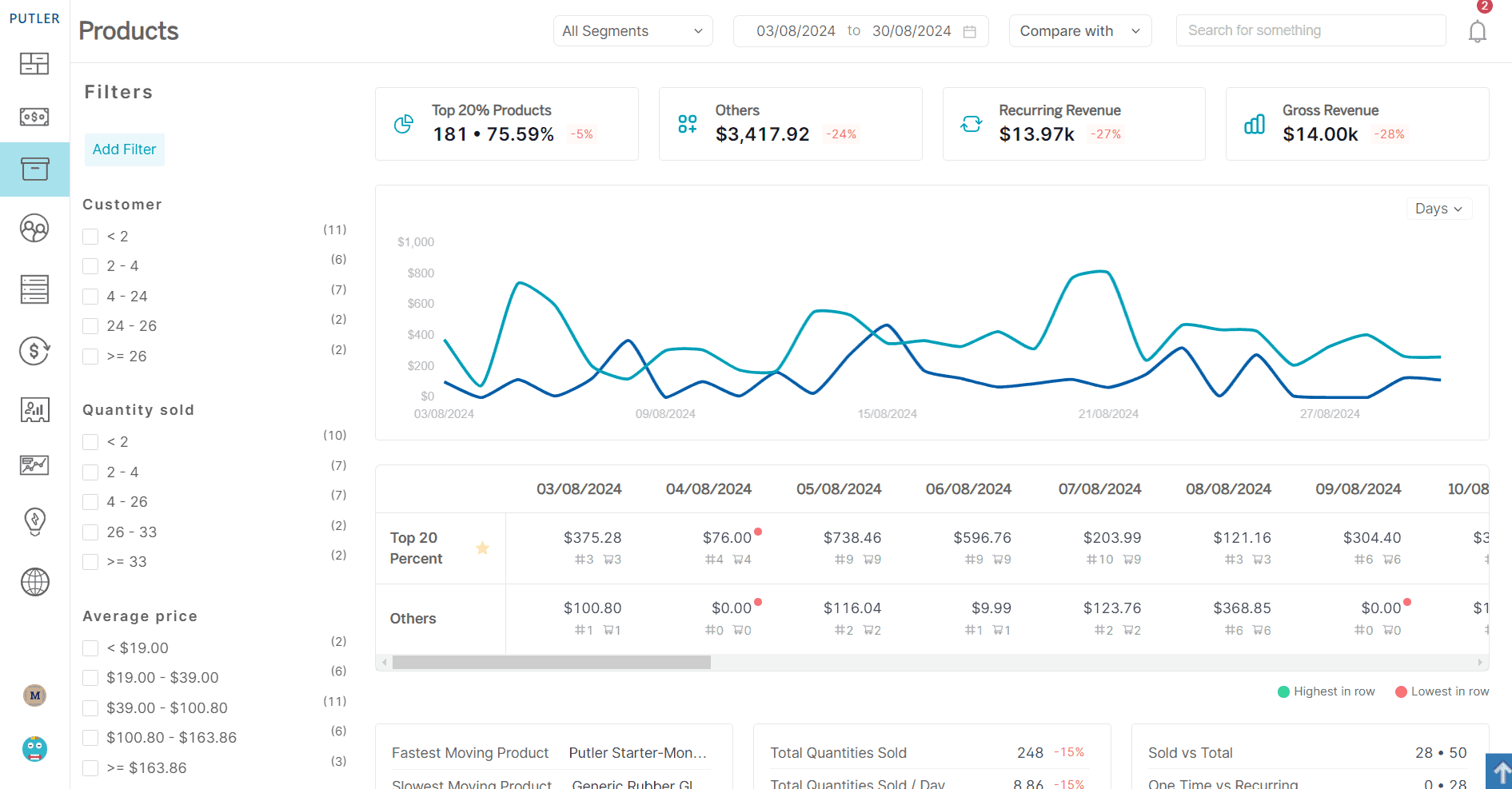

Comprehensive Product Metrics

Products are crucial to your sales, and Putler provides a wealth of instant details about your product movements. From best sellers and product leaderboards to top 20% product revenue and product-wise sales and refunds, Putler has it all. You can read more about how to understand your product metrics better with Putler, here.

What to do:

- Navigate the issues around product performance and bridge the gap between customer expectations and marketing.

- Based on product metrics, improve your strategy for slow-moving products. Try and encourage customers to buy by offering them as bundles with top-performing products.

For example, if you are selling an eCommerce product like a smartwatch, you can also offer accessories, such as trendy detachable pairs of wristbands, as bundles with the main product. You can either upsell them and earn a maximum profit margin.

But wait, there’s more! Putler also offers these amazing features:

- Data Cleansing: Ensure your data is accurate and reliable for better decision-making.

- Sales Heatmaps: Visualize your sales data in an easy-to-understand heatmap format.

- Weekly Email Updates: Stay informed with weekly insights delivered straight to your inbox.

- Forecasting: Predict future sales and plan accordingly for optimal growth.

- Holiday Season Analysis: Get insights into seasonal trends to maximize your holiday sales.

To make the best use of all these features, all you need to do is integrate Putler with at least three data sources. Once that’s done, all you need to do is buckle up to explore the untapped opportunities of your business.

Ready to get better PayPal analytics and reporting?

In the world of business, records are everything. They are the evidence of your transactions and help you make informed decisions. And when it comes to online businesses, the right tools can make all the difference.

Putler is the unsung hero when it comes to offering comprehensive reports and analytics for PayPal transactions. With its user-friendly interface, seamless synchronization of multiple accounts, and extensive range of tracked metrics (200+), Putler truly deserves the credit it gets.

If you conduct business online and rely on PayPal for its efficiency in handling online payments, then Putler is a must-try tool.

Experience the efficiency and simplicity it brings to your PayPal reporting and analytics. From customer segmentation to product insights and forecasting, Putler empowers you with invaluable data to propel your eCommerce success.

Make the smart choice today and elevate your PayPal analytics game with Putler.

FAQs

How far back do PayPal reports go?

PayPal keeps your transaction data for up to 7 years. This means you can access your historical records going back a full 7 years from today’s date. Useful for long-term financial tracking.

Does PayPal delete old transactions?

No, PayPal doesn’t delete your old transactions. They hold onto all the details – payments, refunds, fees, customer ID for 7 years. But after you hit this retention period paypal delete your transaction data.

How long do PayPal activity reports take?

It depends on what you’re asking for, but generally, it takes 5 business days. If you’re pulling a massive amount of data or looking at a really long time period, it might take a bit longer.

how can i get historical data? That’s the only way I can truly identify my loyal customers. I have data going back to 2011

Yes, I completely agree that you need to have a complete overview to find out the exact loyal customers. That’s why Putler can pull in historical data. So if you need historical data of the past 7 years, I suggest you opt for Putler’s Scale Plan.

Can I get an example of the reports you can generate.

You can take a look at Putler Marco Polo here – https://demo.putler.com/beta/