A lot has advanced in business, making the need for a robust payment structure indispensable.

With a shift in business function, its models have turned diverse as well.

Some examples include crowdfunding portals, service aggregators, and other diversities showing up on the horizon.

Besides businesses, digital payments have also touched on how daily transactions function.

As per the World Bank, two-thirds of adults across the globe make or receive digital payments.

Razorpay is turning out to be a pioneer in the space with its array of features, especially Razorpay multiple accounts.

Let’s take a look at how Razorpay is making transactions easier for businesses, its shortcomings, and more.

Why invest in multiple Razorpay accounts?

Separate Razorpay accounts can be used for businesses, projects, or websites functioning independently.

Additionally, multiple Razorpay accounts are significantly helpful for companies that operate in various locations and currencies.

Sorted Tax and Legal Information

Currently, each Razorpay merchant can only be associated with the tax ID. (for eg: GST) and legal entity information of one business.

If a user operates multiple businesses with separate tax ID information, they must pay additional Razorpay merchant accounts for each.

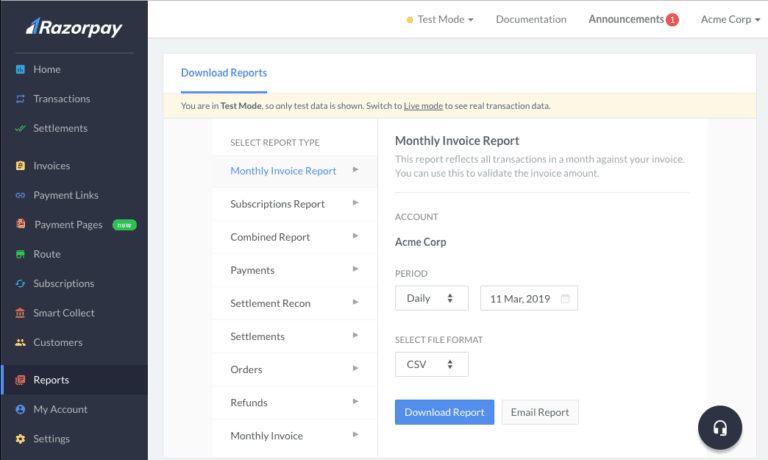

Accurate Reporting

Separating payments processed by diverse independent businesses or verticals makes it easier for merchants to find or filter payments.

Moreover, it creates and exports reports and reconciles payouts to bank accounts.

Razorpay multiple accounts also aids in making financial reports in minutes. This is done with the help of automated reconciliations while eliminating the need for manual processes.

Quick and Accurate Bank Payouts

Razorpay accounts help with instant and secure payment transactions to bank accounts.

Moreover, bulk payouts can also be sent out with one click.

Taking promptness and accuracy a step further, you can also find previous transactions in seconds.

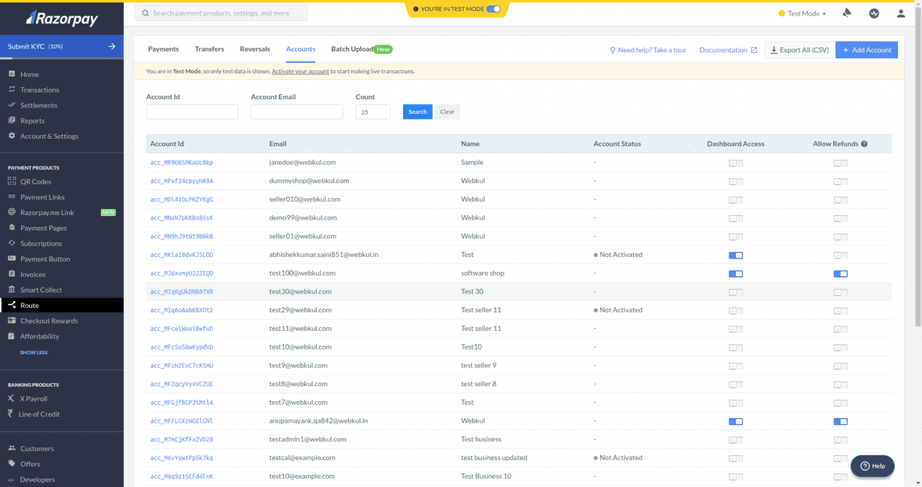

Can I have more than one Razorpay account?

Yes, you can also have multiple linked accounts, and that too with the same email address.

Here’s when you might consider having multiple Razorpay accounts:

- Across different parent merchants

- At the merchant level, however, the email addresses of multiple linked accounts should be unique

If you need to update the email address of a created linked account, you can do so through the dashboard.

However, keep in mind that managing Razorpay multiple accounts means remembering separate credentials and switching between them. We understand, that juggling multiple accounts and credentials can be a hassle while handling your daily tasks.

And that’s where Putler can help!

Simply create the account once, and join them with Putler.

Doing so will save you the hassle of switching accounts, rather you can look into those accounts from Putler itself. No need to remember multiple credentials!

As per Verizon, 61% of breaches are caused by stolen or compromised credentials.

Another option is to create multiple sub-accounts.

This would make it easy for merchants to manage multiple businesses on the Razorpay account and thereby improve customer experience.

How to set up Razorpay multiple accounts?

Setting up a Razorpay account is a simple procedure and can be done with a few steps.

Here’s what you must do:

- Navigate to the Razorpay home page and select the ‘Sign up’ option at the top right corner

- Add your email address and create a password for your new account

- After you add the credentials, verify your account by clicking on the link in the email

- After the verification is done, log into the Razorpay account and begin setting up the payment gateway

- Add additional details such as the business name, the industry, and its annual online turnover

- Enter your bank account details for the payment to be deposited

- Razorpay will then review and approve your application, allowing you to start accepting payments

You can contact the Razorpay customer support team in case of any queries, concerns, or roadblocks during the process.

To set up multiple Razorpay accounts, repeat the above steps for each additional account you wish to create.

Make sure to enter unique credentials and details for each account.

Advantages of having multiple Razorpay accounts

Razorpay offers numerous benefits to its users.

Here are some advantages of having multiple accounts:

Enhanced Financial Management

Users can manage payments to vendors, employees, and other stakeholders through the tool’s financial CRM. As a result, it helps with making informed financial decisions.

Furthermore, it also simplifies payment integration which includes a wide range of payment modes, including cards, mobile wallets, and UPI.

These features can significantly help businesses with global expansion.

Improved Transaction Tracking

Access to multiple Razorpay accounts eliminates the need for bug-filled software and manual processes.

Through Razorpay analytics, you can now control, track, and analyze your payment movements in one unified platform.

You can also target specific areas of your business based on data and insights.

A comprehensive Razorpay analytics dashboard also helps with analytical insights, real-time data, and extensive reports.

Better Customer Experience

Multiple Razorpay accounts help you save time, resources, and effort, leading to a superior customer experience.

The platform’s wide range of payment services and solutions further refines customer interactions.

For one-time scenarios such as workshops or fund-raising, you can create a Razorpay payment link and a payment page.

These features aid with easy payment acceptance in multiple currencies.

Disadvantages of having multiple Razorpay accounts

Despite the benefits, there are some drawbacks to consider:

Increased Management Complexity

Juggling multiple accounts can come across as an additional cost, and might require technical expertise for its integration, maintenance, and management.

Integrating third-party solutions can further complicate processes, consuming resources and efforts.

Potential Confusion for Customers

Users have reported varying satisfaction levels when juggling multiple Razorpay accounts at once.

Despite the existence of help channels, not all users might be able to find the solution they are looking for.

Extra Maintenance Effort

While Razorpay payment gateway charges transaction fees for completed transactions, these costs can accumulate.

This can impact the business’s bottom line, especially for businesses with large transaction volumes.

Now, let’s understand how you can easily monitor multiple Razorpay accounts.

How to monitor multiple Razorpay accounts in a single place?

Curious about managing everything under one roof?

Razorpay Route helps simplify payment transactions through automation which helps handle transactions through third parties, a network of sellers, and bank accounts with robust APIs.

It also offers flexibility by giving them full control of their payment methods, schedules, reconciliations, and refunds.

To take flexibility a notch above, this tool also allows you to collect payments through multiple gateways like debit cards, credit cards, UPI, net banking, and various wallets.

Razorpay Route manages the entire split payments lifecycle, enabling instant distribution and resolving seller refund disputes.

Moreover, it automates commission payments, eliminating manual processes and reducing processing time.

As each business model could be different, Razorpay Route also offers customization with flexible plans.

However, users might still often find the fees to be costly, or some might find the customer service operations to be inconvenient. There could be many reasons why users might be compelled to find another option.

But, Putler takes things a notch higher.

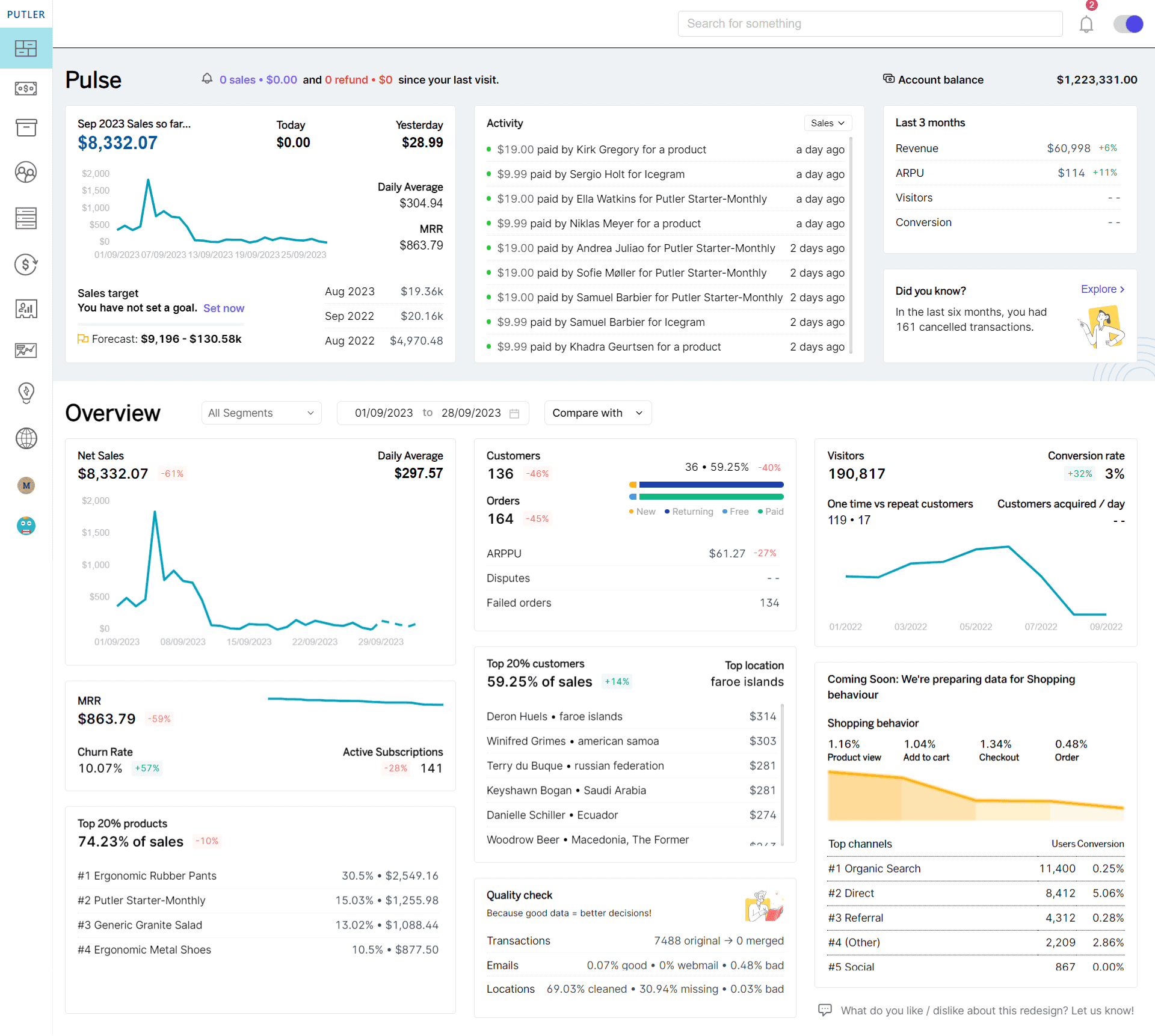

Managing Razorpay multiple accounts in Putler is an easy breeze and comes with many advantages.

Let’s dig deeper into this.

Advantages of using Putler for your multiple Razorpay accounts

Putler helps businesses with several aspects.

Here’s how Putler can be helpful for Razorpay multiple accounts:

Enhances Razorpay Reporting

With the Razorpay integration ability housing one or multiple Razorpay accounts, Putler fetches, cleans, and enriches data.

Putler elevates your Razorpay reporting by providing comprehensive reports and insights into transactions from your Razorpay gateway.

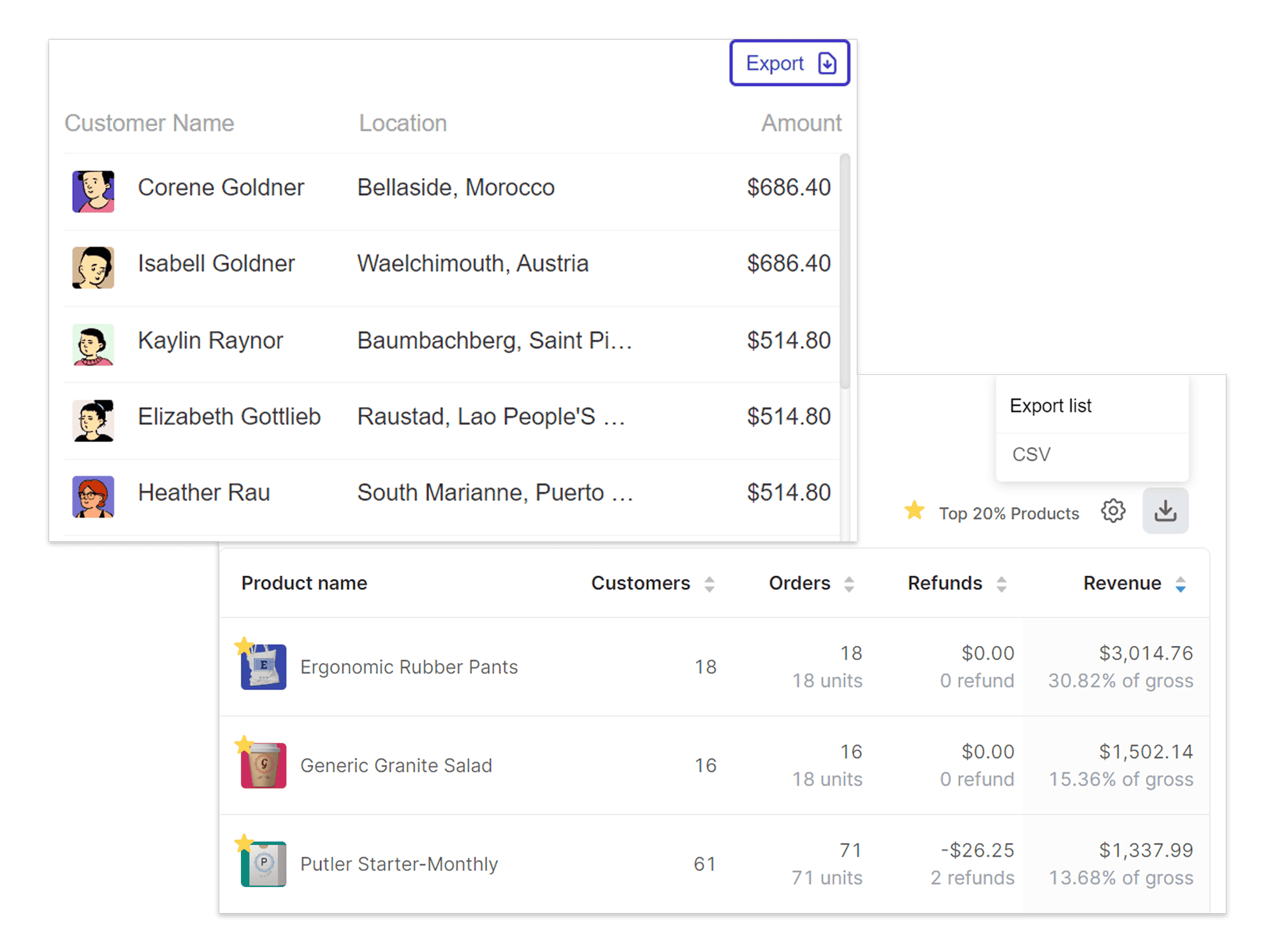

It offers in-depth reports on products, orders, customers, sales, transactions, website visitors, and more.

Also, it lets you export reports in one click, providing actionable insights for monitoring and growing your Razorpay business effectively.

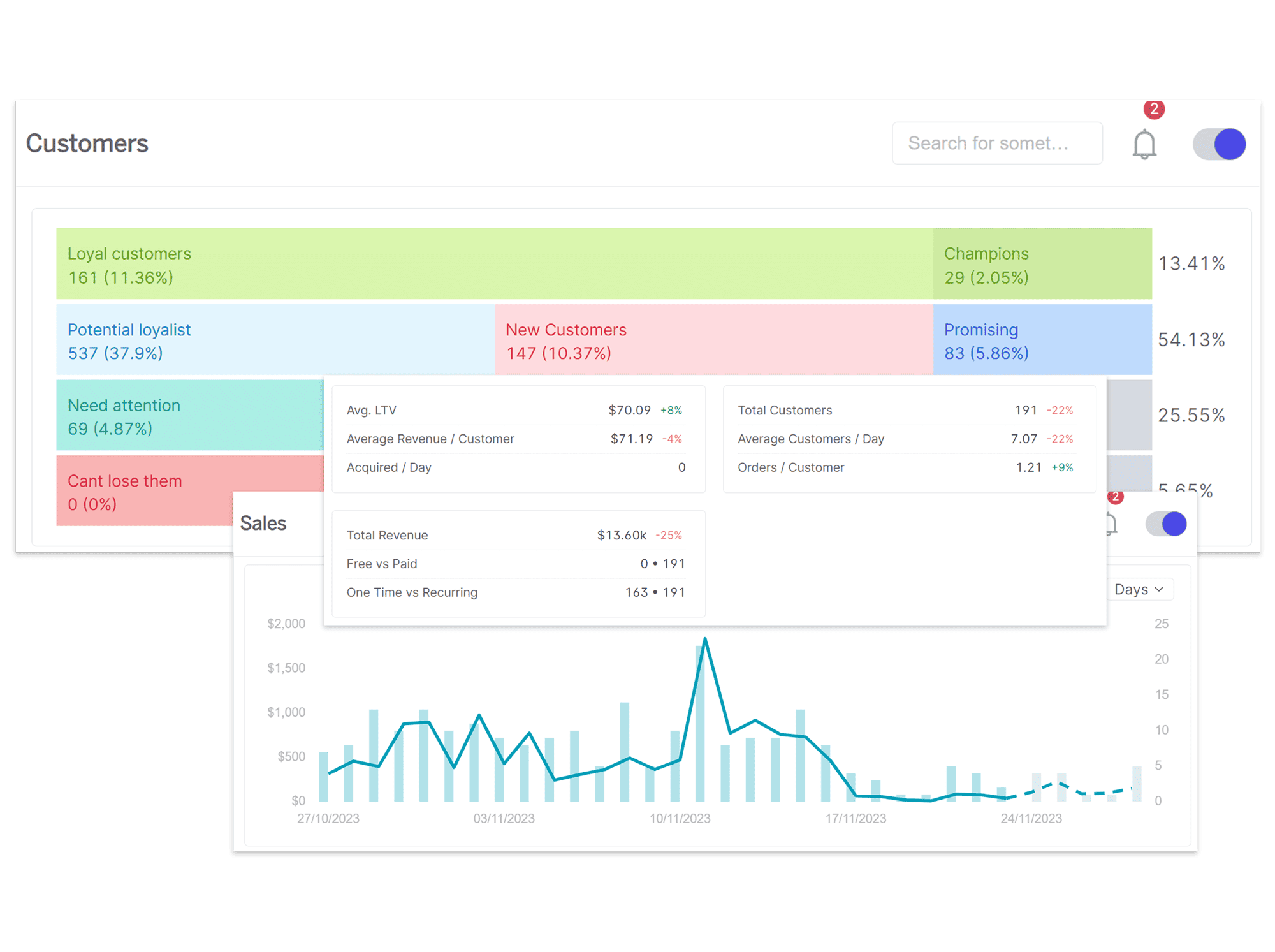

Offers Separate Dashboards

Putler provides dedicated dashboards for your sales, customers, products, transactions, and more.

This keeps you from messing up while making informed decisions for your business.

Also, it allows you to manage your Razorpay accounts individually as well as comprehensively.

This ensures clear and organized management of transactions and analytics for each account.

Manages Orders in Seconds

Say goodbye to the days of searching for a needle in a haystack!

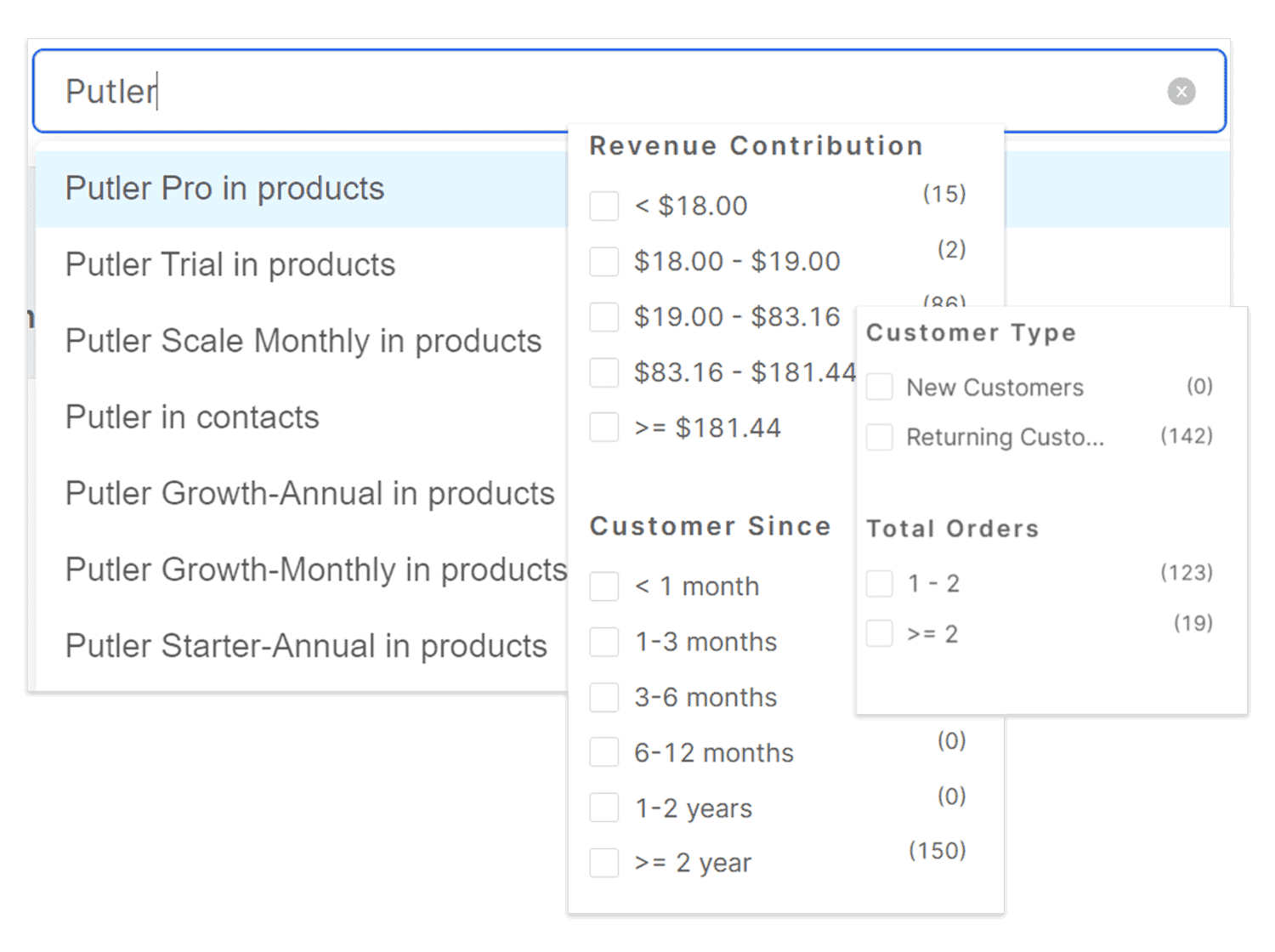

Putler empowers you to effortlessly find customers, orders, products, refunds, and more within seconds.

Additionally, you can create teams within Putler and share the dashboard with them, allowing for simultaneous monitoring of actions.

Business Intelligence and Growth

Putler’s robust analytics unveil the best time, products, and customers to run offers, facilitating targeted marketing strategies.

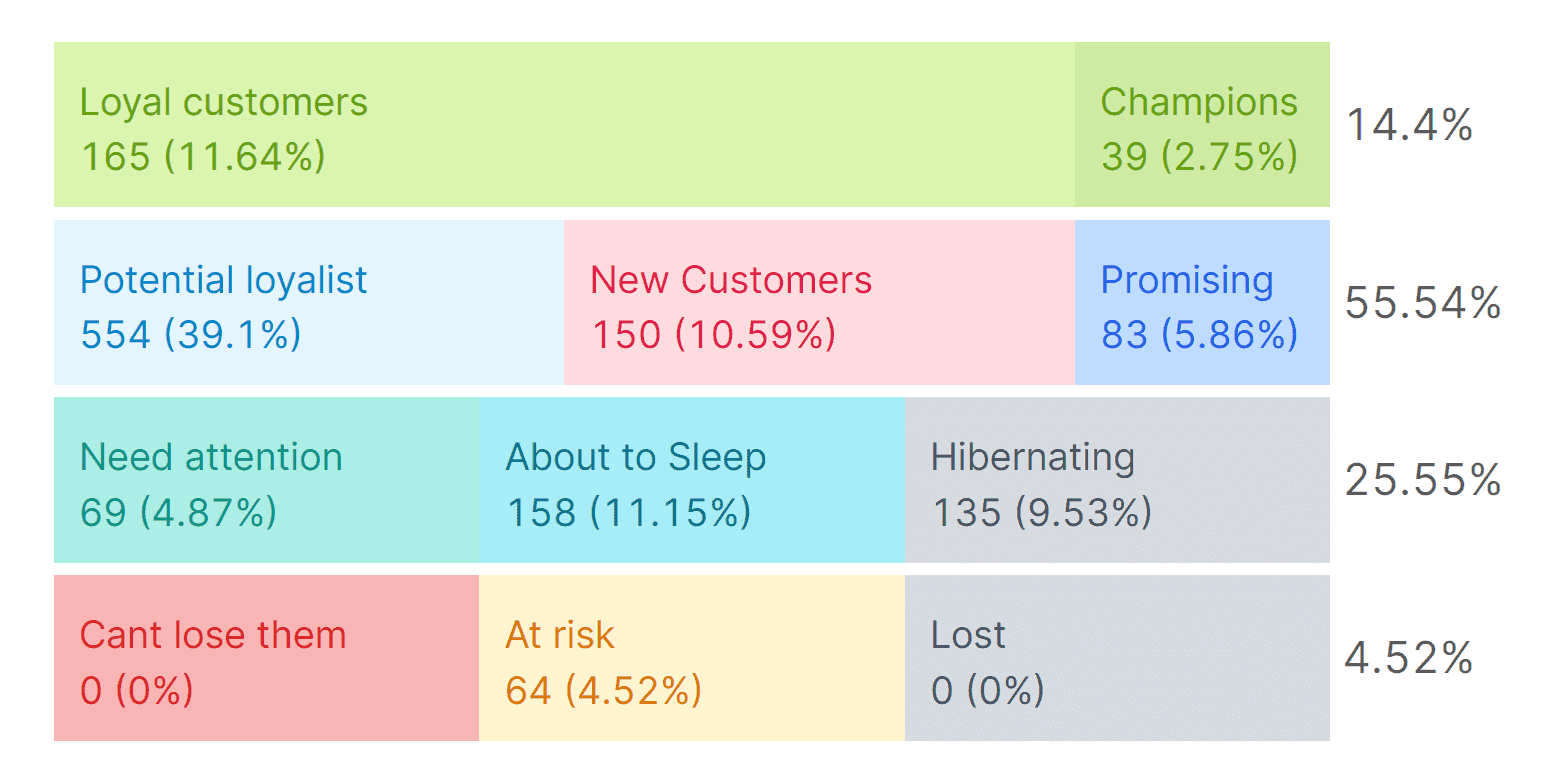

With RFM segmentation and infinite filtering capabilities, Putler enables pinpointed searches across various verticals.

Furthermore, Putler facilitates setting and tracking monthly revenue goals and identifies trends such as BFCM sales, making revenue management a breeze.

Other features of Putler include –

- 200+ metrics

- 36+ Currency Support

- Sales Heatmap

- Sales/Revenue Forecasting

- Instant and Secure Refunds

- Activity Log

- Products Bought Together

- Weekly Email Updates

and a lot more.

Conclusion

Razorpay payment gateway has emerged as a prominent and leading payment gateway which has allowed its users to accept payment and grow to global horizons seamlessly.

Its features are all set to help businesses of all sizes, yet businesses must also consider its restrictions before taking the final call.

While businesses might look for the best payment transaction solutions, they would want more value added to those solutions.

If you are still looking, why not give Putler a try?

Get in touch with us and see how Putler can change payment transactions for you!

FAQ

Why does Razorpay deduce money?

Razorpay levies a small fee for processing instant payments. This fee is deducted from your Razorpay Balance while processing the refund.

For domestic cards, net banking, and wallets, the fee charged is 2% along with 18% GST on the fee.

Does Razorpay support UPI?

Yes, the Razorpay payment gateway supports UPI. It helps you process payments online as well as offline.

What are the payment methods supported in Razorpay?

The following payment methods are supported by major credit and debit cards, 50+ net banking solutions, UPI, EMI, and wallets that include the following:

- Mobikwik

- PayUmoney

- FreeCharge

- Airtel Money

- Ola Money

- PayZapp