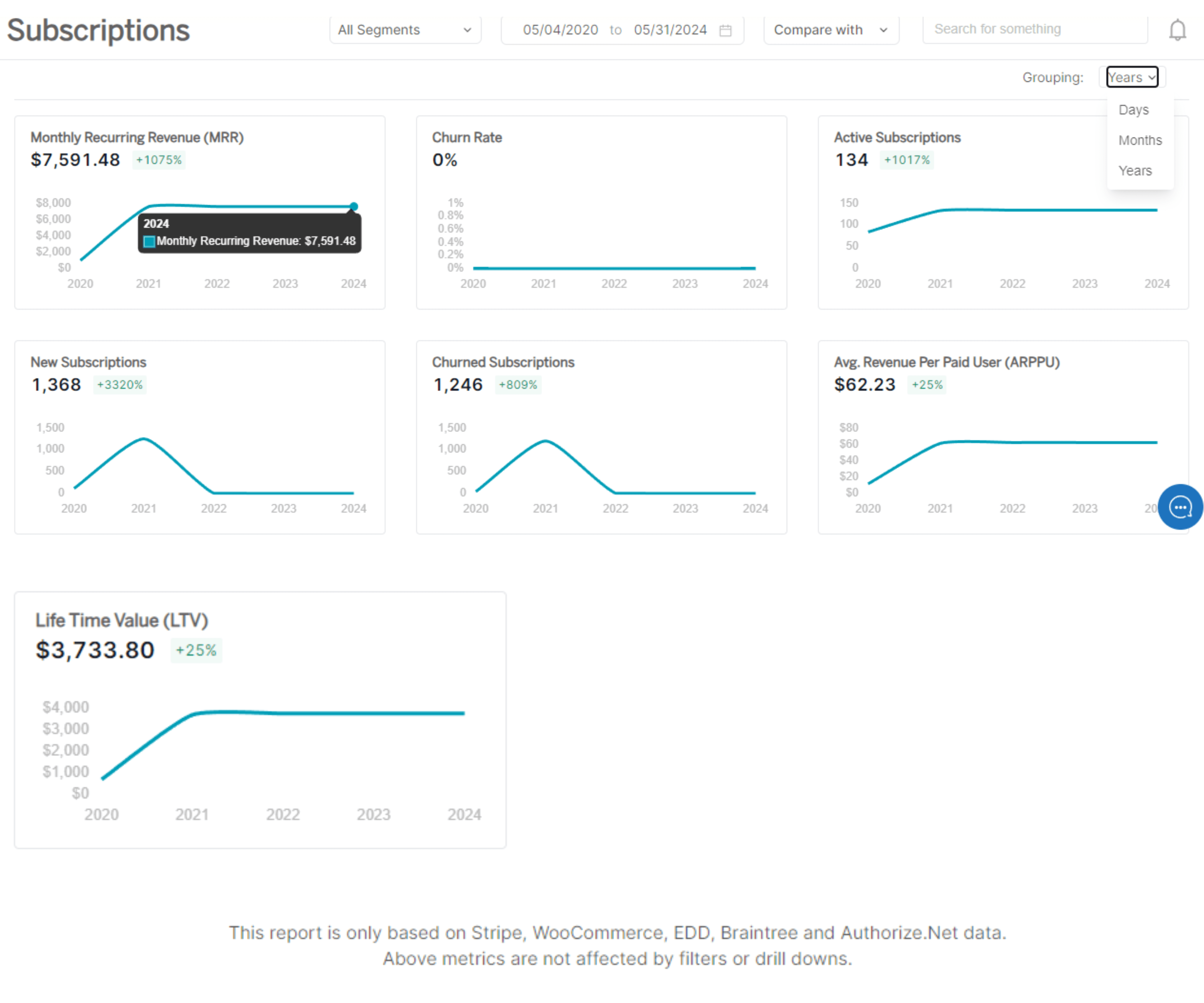

Subscriptions Dashboard

Putler’s Subscriptions dashboard provides all the key metrics related to your subscription products.

This dashboard supports these platforms: Stripe, WooCommerce, EDD, Braintree, Authorize.Net, and Inbound. So if your subscription business is based on any platform other than the ones mentioned above, Putler won’t be able to provide you SaaS reports.

For a comprehensive view, use the Subscriptions dashboard to group your data by days, months, or years

SaaS metrics

SaaS (Software as a Service) metrics help businesses track key performance indicators such as customer growth, revenue, and churn rate. These metrics provide insights into customer behavior, subscription performance, and long-term business sustainability.

MRR

Introduction

Monthly Recurring Revenue (MRR) is a pivotal metric for SaaS (Software as a Service) businesses, providing a clear picture of predictable revenue streams from subscription-based services.

It reflects the accurate MRR value after taking into account various components, pricing plans, and time intervals for active subscriptions within a given period, typically a month. Monitoring and optimizing MRR is crucial for sustainable growth and profitability in the SaaS industry.

How to calculate MRR?

Net MRR = Current MRR + New MRR + Expansion MRR – Churned MRR

In this method, Consider the current MRR from all active subscriptions ($10,000 in our case). Add the additional revenue from new customers acquired and upsells. Subtract downgrades and cancelled subscriptions amount to get the final MRR.

New MRR

New customers contribute directly to MRR growth. In the above example, 12 new customers purchased a $100 monthly plan. 3 new customers purchased a $1500 annual plan, and 20 new customers took the discounted plan. So the sum of all these three is ‘New MRR’. New MRR = $1200 + $375 + $1700 = $3275

Expansion MRR

The revenue earned through upselling will contribute to an increased MRR. In the current case, 15 customers upgraded their plan from $100 to $150. The revenue from these upsells is called ‘Expansion MRR’. Expansion MRR = 15*(150-100) = $750

Churned MRR

If some of your customers cancel their subscription in the current month or downgrade their subscription, the sum of revenue lost from them is called ‘Churned MRR’. In our example, 5 customers cancelled their $100 monthly plan, and 5 customers were downgraded to the $75 plan from the $100 plan. Churned MRR = $500 + $(5*(100-75) = $625) So, putting the values in the MRR formula, your net MRR is: Net MRR = $10000 + $3275 + $750 – $625 = $13400 In either approach, the final MRR comes the same.

Refunds are not reflected in MRR. But refunds are shown separately and their effects will be reflected in your total revenue.

How to use this metric?

- Financial Planning: Enables accurate budgeting and resource allocation based on projected revenue.

- Business Strategy: Guides decisions on pricing, marketing, and customer acquisition strategies.

- Performance Evaluation: Measures the effectiveness of initiatives aimed at increasing subscription renewals and reducing churn.

Benefits

- Predictability: MRR offers insights into future revenue streams, aiding financial forecasting and planning.

- Performance Tracking: It helps gauge the health of subscription growth and customer retention efforts.

- Valuation: Investors often use MRR as a key indicator of a SaaS company's value and potential for growth.

Churn Rate

Introduction

User churn rate is a crucial metric for any business that relies on recurring revenue. It measures the percentage of paying customers who stop using your product or service within a given period, typically a month. A high churn rate can be a red flag indicating potential issues with customer satisfaction, product-market fit, or service quality.

How is the Churn Rate calculated?

User churn rate formula

User Churn Rate = (Cancelled customers in the last 30 days ÷ Active paying customers 30 days ago) x 100

As of today, a 10% user churn rate implies, 10% of the total active paying customers you had 30 days ago have canceled within the last 30 days.

How to use this metric?

- SaaS Companies: SaaS businesses can use churn data to improve their product offerings, customer support, and pricing strategies.

- Subscription Services: Businesses offering subscription services, like streaming platforms or subscription boxes, can use churn metrics to enhance their offerings and customer engagement.

Benefits

- Improved Customer Retention: By identifying and addressing the reasons for churn, you can improve your retention rates.

- Enhanced Customer Experience: Understanding churn can help you make necessary improvements to your product or service, leading to a better customer experience.

- Better Resource Allocation: Knowing where and why churn happens allows you to allocate resources more effectively to reduce it.

- Higher Profitability: Reducing churn leads to higher customer lifetime value and profitability.

Active Subscriptions

Introduction

Putler one of its key features is the ability to track active subscriptions, which is crucial for businesses relying on recurring revenue. Understanding your active subscriptions helps you manage customer relationships, forecast revenue, and make informed business decisions.

It is unique Subscriptions, excluding canceled or non-converted trials.

How to use this metric?

- Subscription-Based Businesses: Monitor and analyze active subscriptions for consistent revenue flow and improvement areas.

- E-commerce Stores: Track subscriptions to manage inventory, forecast demand, and enhance customer satisfaction.

- Financial Planning: Use Subscriptions data for accurate financial models and strategic decision-making.

- Customer Success Teams: Leverage insights to engage customers, reduce churn, and enhance customer experience.

Benefits

- Revenue Forecasting: By tracking the number of active subscriptions, you can accurately forecast your monthly and annual revenue. This helps in budgeting and financial planning.

- Customer Retention: Monitoring active subscriptions allows you to identify trends in customer behavior. You can spot potential churn risks early and take proactive measures to retain customers.

- Performance Metrics: Active subscriptions data provides key performance metrics such as Customer Lifetime Value (CLV) and Monthly Recurring Revenue (MRR), which are essential for assessing the health of your business.

New Subscriptions

Introduction

Acquiring new subscriptions is crucial for the growth and sustainability of any business. Understanding and tracking new active paying customers within specific time frames provides valuable insights into the effectiveness of your marketing and sales efforts.

How to use this metric?

- Product Development: Use insights from new subscriptions to inform product development and feature enhancements that attract more customers.

- Sales Strategy: Adjust sales strategies based on trends in new subscriptions to optimize conversion rates and improve sales funnel efficiency.

- Customer Retention: Identify patterns among new subscribers to proactively address churn risks and enhance retention efforts.

Benefits

- Business Growth Insights: Gain visibility into the growth trends of your customer base.

- Revenue Forecasting: Predict future revenue streams based on subscription trends.

- Customer Behavior Analysis: Understand what drives new customers to subscribe and optimize marketing efforts accordingly.

Churned Subscriptions

Introduction

Churned Subscriptions refer to customers who have discontinued their subscription or service within a specified period. This metric is crucial for businesses as it directly impacts revenue and customer retention strategies.

How to use this metric?

- Performance Evaluation: Evaluate monthly, quarterly, or yearly churn rates to assess business performance and identify trends.

- Retention Strategies: Develop and refine strategies to reduce churn rates based on analysis of churned subscription data.

- Customer Segmentation: Segment customers based on churn behavior to tailor marketing efforts and improve customer satisfaction.

Benefits

- Revenue Stability: Identifying churned subscriptions helps businesses predict and manage revenue fluctuations.

- Improving Customer Retention: Insights from churn data enable businesses to implement targeted retention strategies, such as personalized offers or enhanced customer support.

- Enhanced Product Development: Understanding why customers churn can provide valuable feedback for improving products or services.

ARPPU

Introduction

Average Revenue Per Paid User (ARPPU) tells you how much revenue you’re generating from each of your paying customers on average.

Average Revenue Per Paying User (ARPPU) is the average amount of money you make from a paying customer.

ARPPU formula

ARPPU = Monthly Recurring Revenue / Active Paying Customers

Example – If your monthly recurring revenue is $10000 from 100 paying customers, your ARPPU will be $100.

How to use this metric?

- Financial Services: Evaluating revenue from premium customers or subscribers.

Benefits

- Financial Health Indicator: Provides insights into revenue trends and stability from paying customers.

- Segmentation and Targeting: Identifies high-value customer segments for tailored marketing strategies.

- Performance Evaluation: Evaluate pricing strategies, upselling efforts, and promotional campaigns.

Life Time Value (LTV)

Introduction

Life Time Value (LTV), also known as Customer Life Time Value (CLV), is the estimated predictive monetary value that can come from a customer’s business transactions in the future before they churn.

LTV formula

LTV = Average Recurring Revenue per User / User Churn Rate

How to use this metric?

- Subscription Businesses: Crucial for evaluating subscription models and predicting revenue for SaaS, media streaming, etc.

- Service-Based Industries: Aids service providers in estimating client value, refining services, and boosting long-term customer satisfaction.

Benefits

- Strategic Decision Making: Guides decisions on customer acquisition costs, marketing strategies, and product development by understanding each customer's long-term value.

- Customer Segmentation: Facilitates targeted marketing and personalized experiences by segmenting customers according to their potential lifetime value.

This document provides an overview of the features and benefits of the Subscriptions Dashboard in Putler. For more information or assistance, please refer to the Putler FAQ docs or contact our support team.